| Revision as of 14:41, 8 June 2009 edit80.213.196.154 (talk) →Approach to Models Linked to Austrian Economics← Previous edit | Latest revision as of 23:33, 15 January 2025 edit undoGuardianH (talk | contribs)Extended confirmed users59,805 edits →Education: ceTag: Visual edit | ||

| Line 1: | Line 1: | ||

| {{Short description|Lebanese-American author (born 1960)}} | |||

| WP:OFFICE | |||

| {{Use dmy dates|date=January 2023}} | |||

| {{Infobox scientist | |||

| {{Infobox_Scientist | |||

| | name |

| name = Nassim Nicholas Taleb | ||

| | image |

| image = Taleb mug.JPG | ||

| | |

| caption = Taleb in 2010 | ||

| | |

| birth_date = {{Birth-date and age| 12 September 1960}} | ||

| | |

| birth_place = ], Lebanon | ||

| | |

| death_date = | ||

| | |

| death_place = | ||

| | nationality = ] and ] | |||

| | death_place = | |||

| | |

| alma_mater = {{plainlist| | ||

| * ] (], ]){{Clarify|post-text=(see ])|date=August 2023}} | |||

| | citizenship = | |||

| * ] (]) | |||

| | nationality = | |||

| * ] (])}} | |||

| | field = Scholar, Essayist, Public Intellectual, Statistician, Risk Engineer and Trader | |||

| | thesis_title = The Microstructure of Dynamic Hedging | |||

| | work_institution = ] | |||

| | thesis_year = 1998 | |||

| | alma_mater = ] at the ] (]), ] Dauphine (]) | |||

| | doctoral_advisor |

| doctoral_advisor = ] | ||

| | doctoral_students |

| doctoral_students = | ||

| | known_for |

| known_for = Applied ], ], ], ], ] | ||

| | website = {{URL|http://fooledbyrandomness.com}} | |||

| | author_abbreviation_bot = | |||

| | field = ], ], ] | |||

| | author_abbreviation_zoo = | |||

| | work_institution = ]<br />] | |||

| | prizes = | |||

| | prizes = ], Wolfram Innovator Award | |||

| | religion = ]<ref>{{cite web|url=http://www.fooledbyrandomness.com/notebook.htm|title=Opacity and a-Platonicity: A Philosophical & Literary Notebook|author=Nassim Taleb|quote=I am Greek-Orthodox|accessdate=2007-08-13}}</ref> | |||

| | footnotes = | |||

| }} | }} | ||

| '''Nassim Nicholas Taleb''' (born 1960) ({{lang-ar|نسيم نيقولا نجيب طالب}}) (alternative spellings of first name: '''Nessim''' or '''Nissim''') is a literary ] <ref></ref>, ], researcher, and former practitioner of ].<ref>, Bryan Appleyard, ], June 1, 2008</ref><ref>, Stephanie Baker-Said, ], May 2008</ref><ref>, Susannah Herbert, ], April 2, 2008</ref><ref>, Stephen J. Dubner, ], May 21, 2007</ref> A specialist in financial ]<ref> Link to record </ref> (while critical of the industry), he held a "day job" in a lengthy senior trading and ] career in a number of ]'s ] firms, before starting a second career as a scholar in the | |||

| ] of ] events to focus on his project of mapping how to live and act in a world we do not understand, and how to come to grips with randomness and the unknown —which includes his ] of unexpected rare events.<ref name=Edge>{{cite web | |||

| | title = Learning to Expect the Unexpected | |||

| | year = 2006 | |||

| | url = http://www.edge.org/3rd_culture/taleb04/taleb_index.html | |||

| | accessdate = 2006-09-19 }}</ref>. Taleb has also, in the wake of the economic crisis that started in 2008, become an activist for a "Black Swan robust society"<ref>http://www.ft.com/cms/s/0/fbaff18c-23d2-11de-996a-00144feabdc0.html </ref>,<ref>http://www.fooledbyrandomness.com/maneker.pdf</ref>. | |||

| '''Nassim Nicholas Taleb'''{{efn|{{langx|ar|نسيم نقولا طالب}}}} ({{IPAc-en|ˈ|t|ɑː|l|ə|b}}; alternatively ''Nessim ''or'' Nissim''; born 12 September 1960) is a ] essayist, ], former ], ], and ].<ref name=Berenson>{{cite news| last=Berenson| first=Alex|author-link=Alex Berenson| url=https://www.nytimes.com/2009/09/12/business/12change.html?pagewanted=2 |title=A Year Later, Little Change on Wall St.| work=]| date=11 September 2009| quote=Nassim Nicholas Taleb, a statistician, trader, and author, has argued for years that. ...}}</ref><ref name=Maslin>{{cite news| last=Maslin| first=Janet|author-link=Janet Maslin| url=https://www.nytimes.com/2010/11/17/books/17book.html |title=Explaining the Modern World and Keeping It Short| work=]| date = 16 November 2010 |quote=In his happily provocative new book of aphorisms, the fiscal prophet and self-appointed flâneur Nassim Nicholas Taleb aims particular scorn at anyone who thinks aphorisms require explanation. ...}}</ref> His work concerns problems of ], ], ], and ]. | |||

| Taleb's extremely idiosyncratic literary approach consists of providing a modern-day brand of philosophical tale by mixing narrative fiction, often semi-autobiographical, with ] and scientific commentary <ref>http://freakonomics.blogs.nytimes.com/2007/05/21/straight-from-the-black-swans-mouth/</ref>,<ref>http://www.fooledbyrandomness.com/bbc-bedi.mp3</ref>,<ref> | |||

| http://www.businessworld.in/index.php/Interviews/Right-Out-Of-The-Blue.html</ref>,<ref>http://yevgeniakrasnova.com/blogger/</ref>. | |||

| Taleb is the author of the ''Incerto'', a five-volume work on the nature of uncertainty published between 2001 and 2018 (notably, ''The Black Swan'' and '']''). He has taught at several universities, serving as a Distinguished Professor of Risk Engineering at the ] since September 2008.<ref>{{cite web |url=http://www.edge.org/3rd_culture/bios/taleb.html |title=The third culture – Nassim Nicholas Taleb |publisher=Edge |access-date=14 October 2009 |archive-url=https://web.archive.org/web/20130724135339/http://edge.org/3rd_culture/bios/taleb.html |archive-date=24 July 2013 |url-status=dead }}</ref><ref name="nyuedu"/> He has also been a practitioner of ] and is currently an adviser at ]. '']'' described his 2007 book '']'' as one of the 12 most influential books since ].<ref name="STimes">{{cite news |last=Appleyard |first=Bryan |author-link=Bryan Appleyard |date=19 July 2009 |title=Books that helped to change the world |work=] |url=https://www.thetimes.co.uk/article/books-that-helped-to-change-the-world-qbhxgvg2kwh |url-access=subscription}}</ref> | |||

| ==Biography== | |||

| Taleb originates from ], ]. His political ] ] family saw its prominence and wealth reduced by the ] which began in 1975. He is the son of Dr. Najib Taleb, an ] and ] in ], and Minerva Ghosn. Both sides of his family were politically prominent in the Lebanese Greek Orthodox community: on his mother's side, his grandfather and his great-grandfather were both deputy prime ministers of Lebanon; on his father's side, his grandfather was a supreme court judge and, in 1861, his great-great-great-great grandfather was a governor of the Ottoman semi-autonomous province of Mount Lebanon. | |||

| Taleb criticized risk management methods used by the finance industry and warned about ], subsequently profiting from the ] and the ].<ref name="WallSt">{{cite news|last=Patterson |first=Scott |url-access=subscription| url=https://www.wsj.com/articles/SB122567265138591705 |title=October Pain Was 'Black Swan' Gain |publisher=The Wall Street Journal |date=3 November 2008 |access-date=14 October 2009}}</ref> He advocates what he calls a "black swan robust" society, meaning a society that can withstand difficult-to-predict events.<ref name=swans>{{cite news |url=https://www.bloomberg.com/apps/news?sid=aPaQ1qmwpYmw&pid=newsarchive |title=Brevan Howard Shows Paranoid Survive in Hedge Fund of Time Outs |work=] |date=31 March 2009 |quote='black swans' – difficult-to-predict events that can wipe out a fund. The term was popularized by hedge fund manager and author Nassim Taleb."}}</ref> He proposes what he has termed "]" in systems; that is, an ability to benefit and grow from a certain class of random events, errors, and volatility,<ref name="epigenetics">{{cite journal|title=Genes | Antifragility and Tinkering in Biology (and in Business) Flexibility Provides an Efficient Epigenetic Way to Manage Risk |journal=Genes |volume=2 |issue=4 |pages=998–1016 |doi=10.3390/genes2040998 |pmid=24710302 |pmc=3927596 |year=2011 |last1=Danchin |first1=Antoine |last2=Binder |first2=Philippe M. |last3=Noria |first3=Stanislas |doi-access=free }}</ref><ref name="danchinsynd">{{cite web|url=http://www.project-syndicate.org/commentary/the-anti-fragile-life-of-the-economy |title=Antoine Danchin on The Anti-Fragile Life of the Economy |publisher=Project-syndicate.org |date=1 May 2015 |access-date=7 May 2015}}</ref> as well as "convex tinkering" as a method of scientific discovery, by which he means that decentralized ] outperforms directed research.<ref>{{cite journal |last1=Derbyshire|first1=J. |last2=Wright |first2=G. |year=2014 |title=Preparing for the future: development of an 'antifragile' methodology that complements scenario planning by omitting causation |journal=Technological Forecasting and Social Change|volume=82 |pages=215–225 |doi=10.1016/j.techfore.2013.07.001 |url=https://strathprints.strath.ac.uk/52933/1/Derbyshire_Wright_TFSC2014_methodology_that_complements_scenario_planning_by_omitting_causation.pdf}}</ref> | |||

| Taleb received his bachelors and masters in science from the University of Paris<ref>http://query.nytimes.com/gst/fullpage.html?res=940DE2D71539F932A05752C0A96E948260</ref> and holds an ] from the ] at the ], and a ] in ] from the ] (Dauphine) <ref name=sathese>[{{cite web | |||

| | title = French Thesis Database | |||

| | url = http://fct.u-paris10.fr/FCT-APP/visualiserpub.do?code_these=9616484A | |||

| | accessdate = 2008-10-12 }}]</ref> under the direction of Hélyette Geman <ref name=sondir>[{{cite web | |||

| | title = Home Page | |||

| | url = http://www.helyettegeman.com/ }}]</ref>. | |||

| He is currently ] of ] at ]<ref>,</ref> and Visiting Professor at ]. He was the Dean’s Professor in the Sciences of Uncertainty at the Isenberg School of Management at the ], Adjunct Professor of Mathematics at the Courant Institute of ], and affiliated faculty member at the ] Financial Institutions Center. | |||

| ==Early life and family background== | |||

| As a trader, Taleb has said he took a skeptical and anti-mathematical approach to risk and uncertainty and had a severe distrust of models and statisticians and a contempt for finance academics, especially economists. He has held the following positions: | |||

| ] | |||

| Managing director and proprietary trader at ]. Worldwide chief proprietary arbitrage derivatives ] for ], ] and non-dollar fixed income at ]. Chief currency derivatives trader for ]. ] and worldwide head of financial ] ] at ]. Derivatives arbitrage trader at ], proprietary trader at ], as well as independent option market maker on the ]. Founder of ] <ref>http://online.wsj.com/article/SB118429436433665637.html</ref>. | |||

| Taleb was born in ], ], to Minerva Ghosn and Nagib Taleb, an ] and a researcher in ]. His parents were ],<ref name="cadwalladr">{{cite news |first=Carole |last=Cadwalladr |date=24 November 2012 |url=https://www.theguardian.com/books/2012/nov/24/nassim-taleb-antifragile-finance-interview |title=Nassim Taleb: my rules for life |work=] |access-date=7 May 2015}}</ref> and had ]. His maternal grandfather {{Wikidata fallback link|Q43475996}} and great-grandfather {{Wikidata fallback link|Q43476186}} were both ] in the 1940s through the 1970s, and his four-times great grandfather was one of the ] to the administrator of ].<ref name="AUBcommence" /> His paternal grandfather Nassim Taleb was a supreme court judge.<ref>{{cite magazine |url=https://www.newyorker.com/magazine/2002/04/22/blowing-up |title=Blowing Up |magazine=The New Yorker |first=Malcolm |last=Gladwell |date=15 April 2002 |access-date=3 January 2019|via=www.newyorker.com}}</ref><ref>{{cite news |url=https://www.ft.com/content/86648df6-ddca-11e6-86ac-f253db7791c6 |title=How to avert catastrophe |website=Financial Times |date=19 January 2017 |access-date=3 January 2019}}</ref> Taleb attended a French school in Beirut, the ].<ref name=BakerSaid08/><ref name=FT>{{cite news | last=Wighton| first=David| date=28 March 2008| title=Lunch with the FT: Nassim Nicholas Taleb| work=]|url=http://www.ft.com/intl/cms/s/0/2855f64c-f976-11dc-9b7c-000077b07658.html |access-date=7 May 2015}}</ref> His family saw its political prominence and wealth reduced by the ], which began in 1975.<ref>{{cite news | last=Helmore| first=Edward| date=27 September 2008| url=https://www.theguardian.com/books/2008/sep/28/businessandfinance.philosophy | title=The new sage of Wall Street|work=] |access-date=7 May 2015}}</ref> He is a ].<ref name="cadwalladr"/> | |||

| Taleb is currently Principal/Senior Scientific Advisor at ], the Santa Monica, California, fund owned and managed by former Empirica partner ] | |||

| ==Education== | |||

| Taleb considers himself far less a businessman than an epistemologist of ] who used trading to attain his independence and freedom from authority, as he writes in his book, '']'', which became a cult book on Wall Street after it was first published in 2001. It was translated into 23 languages. <ref name=BW>{{cite news | |||

| Taleb received Bachelor and Master of Science degrees from the ].<ref>{{cite news |url=https://query.nytimes.com/gst/fullpage.html?res=940DE2D71539F932A05752C0A96E948260 |title=Business Student Is Wed in Atlanta |work=The New York Times |date=31 January 1988 |access-date=14 October 2009}}</ref> {{Clarify|post-text=(see ])|date=August 2023}} He holds a ] from the ] at the ] (1983),<ref name=BakerSaid08>{{cite news | first=Stephanie| last=Baker-Said| date=27 March 2008| title=Flight of the Black Swan| work=]|url=https://www.bloomberg.com/apps/news?pid=nw&pname=mm_0508_story1.html | archive-url=https://web.archive.org/web/20120326024500/https://www.bloomberg.com/apps/news?pid=nw&pname=mm_0508_story1.html| archive-date=26 March 2012}}</ref><ref name=WallSt /> and a PhD in ] from the ] (1998),<ref name="BBKgeman">BBK, 2015, "Our staff: Helyette Geman, PhD Students, Past Students," at ], Dept of Economics, Mathematics and Statistics, see and , accessed 7 May 2015.</ref> under the direction of ].<ref name=BBKgeman/> His dissertation focused on the mathematics of derivatives pricing.<ref name=BBKgeman/><ref name="DRMFinance15">{{cite web| work=DRM Finance | date=24 June 1998| author=Thèses Soutenes| title=Nassim Taleb, ''Réplication d'option et structure du marché''| url=http://www.cereg.dauphine.fr/these.php?id=107 |access-date=10 May 2015 |url-status=dead |archive-url=https://web.archive.org/web/20150518072514/http://www.cereg.dauphine.fr/these.php?id=107 |archive-date=18 May 2015 |language=fr | trans-title=Replication of Options and Market Structure}}</ref> | |||

| | last = Stone | |||

| | first = Amey | |||

| | title = Profiting from the Unexpected | |||

| | work = News Analysis | |||

| | publisher = ] | |||

| |date=October 24, 2005 | |||

| | url = http://www.fooledbyrandomness.com/busweek.mht | |||

| | accessdate = 2006-09-19 }}</ref> | |||

| == Career == | |||

| Taleb, a ], has a literary fluency in ], ], and classical ], a conversational fluency in ] and ], and reads classical texts in ], ], ], and ], as well as the ] script.<ref name=DS>{{cite news | |||

| === Finance === | |||

| | last = Kolman | |||

| Taleb has been a practitioner of ]<ref>{{cite news| last=Tett| first=G. |date=27 March 2011 | title=Black swans, but no need to flap ...| work=]| page=12| url=https://www.ft.com/cms/s/0/ddd47642-55b7-11e0-a00c-00144feab49a.html |access-date=7 May 2015}}</ref> as a ] manager,<ref name="fortune2024">{{cite web |last1=Daniel |first1=Will |title=The hedge funder who’s made billions providing ‘insurance’ against market crashes insists he’s no permabear: ‘Cassandras make terrible investors’ |url=https://fortune.com/2024/04/06/mark-spitznagel-hedge-fund-permabear-cassandras-make-terrible-investors/ |website=Fortune |access-date=5 August 2024 |quote=...he’s employed Nassim Taleb, the statistician and academic who popularized the concept of the rare and unexpected event called a “black swan,” as a “distinguished scientific advisor.” |date=6 April 2024}}</ref><ref name="universa2024">{{cite web |title=About us |url=https://www.universa.net/aboutus.html |website=www.universa.net |publisher=Universa Investments L.P. |access-date=5 August 2024 |quote=Spitznagel and Universa’s Distinguished Scientific Advisor, Nassim Nicholas Taleb, together began tail hedging formally for client portfolios over twenty years ago.}}</ref> and a ] ].<ref name=BakerSaid08/><ref name="business.timesonline.co.uk">{{cite news |last=Appleyard |first=Bryan |author-link=Bryan Appleyard |date=1 June 2008 |title=Nassim Nicholas Taleb the prophet of boom and doom |work=] |location=London |url=http://business.timesonline.co.uk/tol/business/economics/article4022091.ece |archive-url=https://web.archive.org/web/20080906052320/http://business.timesonline.co.uk/tol/business/economics/article4022091.ece |url-status=dead |archive-date=6 September 2008 |access-date=19 May 2010}}</ref> He has held the following positions:<ref name=NassimTaleb37>Nassim Nicholas Taleb's Curriculum Vitae , at ''fooledbyrandomness.com'' accessed 9 May 2015.</ref><ref>{{cite news|title=Taleb Outsells Greenspan as Black Swan Gives Worst Turbulence |url=https://www.bloomberg.com/apps/news?pid=newsarchive&sid=aHfkhe8.C._8|work=]}}</ref> managing director and proprietary trader at Credit Suisse ], currency trader at ], chief currency derivatives trader for ], managing director and worldwide head of financial ] ] at ], derivatives arbitrage trader at ] (now ]), proprietary trader at ], independent option market maker on the ] and hedge fund manager for ].<ref name="institutional">{{cite magazine |last=Alexander |first=Jan |date=November 2011 |title=Spreading his Wings |url=https://www.institutionalinvestor.com/article/2bszpin5fblf1xw32c1ds/premium/universas-mark-spitznagel-spreads-his-wings |magazine=AR: Absolute Return + Alpha |publisher=Institutional Investor & Hedge Fund Intelligence |pages=24–32}}</ref> | |||

| | first = Joe | |||

| | title = The World According to Nassim Taleb | |||

| | publisher = Derivatives Strategy magazine | |||

| | date = December/January 1997 | |||

| | url = http://www.derivativesstrategy.com/magazine/archive/1997/1296qa.asp | |||

| | accessdate = 2006-09-19 }}</ref> | |||

| Taleb reportedly became ] after the crash of 1987 from his hedged short Eurodollar position while working as a trader for First Boston.<ref name="BakerSaid08" /> Next, Taleb pursued work toward his PhD in Paris, ]. He returned to New York City and ]. During the market downturn in 2000, at the end of the ], Empirica's Empirica Kurtosis LLC fund was reported to have made a 56.86% return. Taleb's investing strategies continued to be highly successful during the ] dive in 2000<ref name=BW /> Several consecutive years of low market volatility and less spectacular returns followed, and Empirica closed in 2004.<ref name="institutional" /> | |||

| ==Research and theories of randomness== | |||

| In 2007, Taleb joined his former Empirica partner, ],<ref name=institutional /> as an adviser to ], an asset management company based on the "black swan" idea, owned and managed by Spitznagel in Miami, Florida.<ref name=WallSt /> | |||

| Taleb calls himself a "skeptical ]", but: | |||

| Taleb attributed the ], to the mismatch between reality and statistical distributions used in finance. Taleb's investing approach produced significant returns once again, with some Universa funds returning 65% to 115% in October 2008.<ref name="WallSt" /><ref>{{cite news |url=https://www.bloomberg.com/apps/news?pid=newsarchive&sid=aW2ByfpGZflA |work=] |title=Taleb Says Business Schools Use 'Bogus' Risk Models (Update1) |date=7 November 2008}}</ref> In a 2007 '']'' article, Taleb claimed he retired from trading and would be a full-time author.<ref name="WSJ_Patterson_2007">{{cite news|last=Patterson |first=Scott |url=https://www.wsj.com/articles/SB118429436433665637 |title=Mr. Volatility and the Swan|publisher=The Wall Street Journal |date=13 July 2007 |access-date=14 October 2009}}</ref> He describes the nature of his involvement as "totally passive" from 2010 on.<ref name=NassimTaleb37 /> | |||

| # Unlike other skeptics, his skepticism is only directed to the fundamental incomputability of the probability of consequential rare events from empirical observations ("Black Swans"), though he accepts that scientific knowledge can deal with the regular ones. Taleb advocates gullibility for things that make us human without adverse consequences, matters in "Mediocristan" <ref></ref>. | |||

| # Taleb's empiricism means the opposite of what is usually interpreted. It implies resisting generalization from data and limiting the derivation of general rules from particular observations as one can be missing hidden properties. Thus he believes that scientists, economists, historians, policy makers, businessmen, and financiers are victims of an illusion of pattern. They overestimate the value of rational explanations of past data, and underestimate the prevalence of unexplainable ] in those data. | |||

| Taleb considers himself less a businessman than an ] of ], and says that he used trading to attain independence and freedom from authority.<ref name=BW>{{cite news|last=Stone|first=Amy|date=23 October 2005|title=Profiting from the Unexpected |work=] |url=https://www.bloomberg.com/bw/stories/2005-10-23/profiting-from-the-unexpected | access-date=7 May 2015}} {{cite web |url=http://www.fooledbyrandomness.com/busweek.mht |title=Profiting from the Unexpected |url-status=dead |archive-url=https://web.archive.org/web/20061021070352/http://www.fooledbyrandomness.com/busweek.mht |archive-date=21 October 2006 |access-date=7 May 2015}}</ref> He advocated for ],<ref>{{cite news|last=Harrington |first=Shannon D. |url=https://www.bloomberg.com/news/2010-07-20/pimco-sells-black-swan-protection-as-wall-street-profits-from-selling-fear.html |title=Pimco Sells Black Swan Protection as Wall Street Markets Fear |work=] |date= 19 July 2010|access-date=1 October 2010}}</ref> which is intended to mitigate investors' exposure to extreme market moves. Tail risk hedging safeguards investors by reaping rewards from rare events, thus Taleb's investment management career has included several jackpots followed by lengthy dry spells.<ref name=BakerSaid08/><ref name="WallSt" /> | |||

| Taleb put a psychological, mathematical, and (mostly) practical framework around the philosophical problems in a long lineage of ] philosophers, including ], ], ], ], ], ] and ] in believing that we know much less than we think we do, and that the past should not be used naively to predict the future. Furthermore, as a practitioner he creates a decision-making framework of "how to act under incomplete understanding, imperfect information". Taleb now focuses on being a researcher in the philosophy of randomness and the role of uncertainty in science and society,<ref name=Umass>{{cite web | |||

| | title = Prof. Nassim Nicholas Taleb — Running with Randomness | |||

| | work = Isenberg School of Management | |||

| | publisher = ] | |||

| | date = February 1, 2006 | |||

| | url = http://www.isenberg.umass.edu/marketing/news/Prof_Nassim_Nichola_207/ | |||

| | accessdate = 2006-09-19 }}</ref> with particular emphasis on the philosophy of history and the role of fortunate or unfortunate high-impact random events, which he calls "]", in determining the course of history. | |||

| Taleb attended the ] annual meeting in ] in 2009; at that event he had harsh words for bankers, suggesting that bankers' recklessness will not be repeated "if you have punishment".<ref>{{cite news |last=Ignatius |first=David |author-link=David Ignatius |date=1 February 2009 |title=Humbled Economic Masters at Davos |newspaper=] |url=https://www.washingtonpost.com/wp-dyn/content/article/2009/01/30/AR2009013002726.html |access-date=14 October 2009}}</ref><ref>{{cite news |last=Redburn |first=Tom |date=28 January 2009 |title=A Rallying Cry to Claw Back Bonuses |work=] |publisher=The New York Times |url=https://dealbook.nytimes.com/2009/01/28/a-rallying-cry-to-claw-back-bonuses/ |access-date=14 October 2009}}</ref> | |||

| Taleb believes that most people ignore "]" because we are more comfortable seeing the world as something structured, ordinary, and comprehensible. Taleb calls this blindness '']'', and argues that it leads to three distortions: | |||

| === Academia === | |||

| # Narrative fallacy: creating a story ] so that an event will seem to have an identifiable cause. | |||

| Taleb shifted his career emphasis to mathematical research in 2006. Since 2008, he has taught classes at ], as Distinguished Professor of Risk Engineering.<ref name="nyuedu">{{cite web |title='Hottest thinker in the world' joins faculty {{!}} NYU Tandon School of Engineering |url=https://engineering.nyu.edu/news/2008/09/08/hottest-thinker-world-joins-faculty |website=engineering.nyu.edu |date=8 September 2008 |access-date=5 August 2024 |publisher=]}}</ref><ref>John F. Kelly, 2008, {{Webarchive|url=https://web.archive.org/web/20120329075549/http://archive.poly.edu/press/_doc/Nassim_Nicholas_Taleb_joins_Polytechnic.pdf |date=29 March 2012 }}, at '']'' (press release), 3 October 2008, accessed 7 May 2014.</ref> and was a Distinguished Research Scholar at the ] BT Center, ] from 2009 to 2013.<ref>{{citation |url=http://www.sbs.ox.ac.uk/ |title=Oxford Said School of Business |archive-url=https://web.archive.org/web/20121021121657/http://www.sbs.ox.ac.uk/centres/bt/directory/Pages/default.aspx |archive-date=21 October 2012 |access-date=28 December 2016 }}</ref> Taleb also held positions at NYU's ], the ], and the ]. | |||

| # ]: believing that the unstructured randomness found in life resembles the structured randomness found in games. Taleb faults random walk models and other inspirations of modern probability theory for this inadequacy. | |||

| # Statistical regress fallacy: believing that the structure of probability can be delivered from a set of data. | |||

| Taleb is Co-Editor in Chief of the academic journal ''Risk and Decision Analysis'' since September 2014,<ref>IOS Press, 2014, , at ''IOS Press'' (online), 19 September 2014, accessed 7 May 2014.</ref> jointly teaches regular courses with ] in London, and occasionally participates in teaching courses toward the ].<ref>"Certificate in Quantitative Finance – Course Guide," at ''Wilmott'', 2008 (online), see {{cite web |url=http://www.wilmott.com/cqf_brochure.pdf |title=Archived copy |access-date=9 May 2015 |url-status=dead |archive-url=https://web.archive.org/web/20120916182524/http://www.wilmott.com/cqf_brochure.pdf |archive-date=16 September 2012}}, accessed 9 May 2015.</ref> He is also a faculty member of the ].<ref>{{Cite web|url=https://necsi.edu/faculty|title=Faculty|website=New England Complex Systems Institute}}</ref> | |||

| He also believes that people are subject to the ''triplet of opacity'', through which history is distilled even as current events are incomprehensible. The triplet of opacity consists of | |||

| # an illusion of understanding of current events | |||

| # a retrospective distortion of historical events | |||

| # an overestimation of factual information, combined with an overvalue of the intellectual elite<ref name=BLKSWN>{{Citation | |||

| | last = Taleb | |||

| | first = Nassim Nicholas | |||

| | title = The Black Swan: The Impact of the highly improbable | |||

| | pages = 8 | |||

| | year = 2007 | |||

| }}</ref> | |||

| === {{Anchor|Writing career}}Writing career === | |||

| Taleb, an anti-], believes that universities are better at public relations and claiming credit than generating knowledge. Knowledge and technology are generated by what he calls "stochastic tinkering", rarely by top-down directed research. | |||

| Taleb's first non-technical book, '']'', about the underestimation of the role of randomness in life, published in 2001, was selected by ] as one of the smartest 75 books known.<ref>{{cite news|last=Useem|first=Jerry|title=The Smartest Books We Know |url=https://money.cnn.com/magazines/fortune/fortune_archive/2005/03/21/8254826/index.htm|access-date=28 August 2013 |newspaper=Fortune|date=21 March 2005}}</ref> | |||

| His second non-technical book, '']'', about unpredictable events, was published in 2007, selling close to three million copies, as of February 2011. It spent 36 weeks on the ],<ref>{{cite web |url=http://www.businessweek.com/magazine/content/11_10/b4218047676960.htm |archive-url=https://web.archive.org/web/20110226142024/http://www.businessweek.com/magazine/content/11_10/b4218047676960.htm |url-status=dead |archive-date=26 February 2011 |title=Charlie Rose Talks to Nassim Taleb |publisher=] |date=24 February 2011 |access-date=7 May 2015}}</ref> 17 as hardcover and 19 weeks as paperback, and was translated into 50 languages.<ref name=BakerSaid08/><ref>{{cite web | url=https://www.swisseconomic.ch/en/profile/nassim-nicholas-taleb | title=Nassim Nicholas Taleb Profile |website=www.swisseconomic.ch}}</ref> The book has been credited with predicting the ].<ref name=BrooksOpEdNYT>{{cite news |author-link=David Brooks (cultural commentator) |first=David |last=Brooks|work=]|quote=Not only did Taleb have an explanation for the crisis, but he saw it coming |url=https://www.nytimes.com/2008/10/28/opinion/28brooks.html?_r=0|title=The Behavioral Revolution |date=27 October 2008}}</ref> | |||

| Taleb stands against grand theories in social science. He supports experiments and fact collecting, but opposes the idea of directing our thinking into general Platonic theories that are not supported by hard data. His work is supported both by qualitative argument and by rigorous technical and quantitative analysis. | |||

| In a 2008 article in '']'', journalist ] described Taleb as "the hottest thinker in the world".<ref name="business.timesonline.co.uk" /> ] proposed the inclusion of Taleb's name among the world's top intellectuals, saying "Taleb has changed the way many people think about uncertainty, particularly in the financial markets. His book, ''The Black Swan'', is an original and audacious analysis of the ways in which humans try to make sense of unexpected events."<ref name="kahneman">{{cite web |last=Kahneman |first=Daniel |author-link=Daniel Kahneman |date=2008 |title=How Could You Not Include ... |url=https://foreignpolicy.com/story/cms.php?story_id=4365 |url-status=dead |archive-url=https://web.archive.org/web/20090329025248/http://www.foreignpolicy.com/story/cms.php?story_id=4365 |archive-date=29 March 2009 |access-date=14 October 2009 |work=]}}</ref> | |||

| Consistent with his anti-Platonism, Taleb doesn't like to see his ideas called "theories". As he stands against general theories and top-down concepts, he never mentions theory in conjunction with the Black Swan. The phrase "Black Swan theory" is, to him, a contradiction in terms, and he urges his readers not to "Platonify" the Black Swan. Rather, Taleb would call his Black-Swan idea an "anti-theory" or the "Black Swan conjecture". | |||

| A book of ]s, '']'', was released in December 2010. | |||

| He opposes the academic aura around economic theories, which in his view suffer acutely from the problem of ]. In an article titled Taleb called for the cancellation of the ], saying that the damage from economic theories can be devastating. | |||

| '']'' was published in November 2012<ref name="TalebAntifragile12" /> and '']'' was published in February 2018. | |||

| ===Ludic fallacy=== | |||

| Taleb's exposition of the ] in '']'' | |||

| <blockquote> | |||

| We love the tangible, the confirmation, the palpable, the real, the visible, the concrete, the known, the seen, the vivid, the visual, the social, the embedded, the emotional laden, the salient, the stereotypical, the moving, the theatrical, the romanced, the cosmetic, the official, the scholarly-sounding verbiage (b******t), the pompous Gaussian economist, the mathematicized crap, the pomp, the Academie Francaise, Harvard Business School, the Nobel Prize, dark business suits with white shirts and Ferragamo ties, the moving discourse, and the lurid. Most of all we favor the narrated. | |||

| </blockquote> | |||

| <blockquote> | |||

| Alas, we are not manufactured, in our current edition of the human race, to understand abstract matters — we need context. Randomness and uncertainty are abstractions. We respect what has happened, ignoring what could have happened. In other words, we are naturally shallow and superficial — and we do not know it. This is not a psychological problem; it comes from the main property of information. The dark side of the moon is harder to see; beaming light on it costs energy. In the same way, beaming light on the unseen is costly in both computational and mental effort. | |||

| </blockquote> | |||

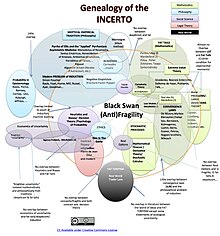

| Taleb's five volume philosophical essay on uncertainty, titled '''''Incerto'''''<!-- bolded per ] as a redirect target -->, includes ''Fooled by Randomness'' (2001), ''The Black Swan'' (2007–2010), ''The Bed of Procrustes'' (2010), ''Antifragile'' (2012), and ''Skin in the Game'' (2018). It was originally published in November 2016 including only the first four books. The fifth book was added in August 2019. | |||

| ===Warning of the Global Banking Crisis=== | |||

| Taleb's non-technical writing style has been described as mixing a narrative, often semi-autobiographical style with short philosophical tales and historical and scientific commentary. The sales of Taleb's first two books garnered an advance of $4 million, for a follow-up book on anti-fragility.<ref name=BakerSaid08/> | |||

| In 2007, in '']''<ref></ref> | |||

| <blockquote>Globalization creates interlocking fragility, while reducing volatility and giving the appearance of stability. In other words it creates devastating Black Swans. We have never lived before under the threat of a global collapse. Financial Institutions have been merging into a smaller number of very large banks. Almost all banks are interrelated. So the financial ecology is swelling into gigantic, incestuous, bureaucratic banks – when one fails, they all fall. The increased concentration among banks seems to have the effect of making financial crisis less likely, but when they happen they are more global in scale and hit us very hard. We have moved from a diversified ecology of small banks, with varied lending policies, to a more homogeneous framework of firms that all resemble one another. True, we now have fewer failures, but when they occur ....I shiver at the thought.</blockquote> | |||

| == Ideas and theories == | |||

| <blockquote>The government-sponsored institution ], when I look at its risks, seems to be sitting on a barrel of dynamite, vulnerable to the slightest hiccup. But not to worry: their large staff of scientists deem these events "unlikely".</blockquote> | |||

| ] | |||

| Taleb's book '']'' summarizes the central problem: "we humans, facing limits of knowledge, and things we do not observe, the unseen and the unknown, resolve the tension by squeezing life and the world into crisp commoditized ideas". Taleb disagrees with ] (i.e., theoretical) approaches to reality to the extent that they lead people to have the wrong ] of reality, rather than no map at all. He opposes most economic and grand social science theorizing, which in his view, suffers acutely from the problem of overuse of Plato's ].<ref name="swans" /> | |||

| ===Success during the 2007-2008 Financial Crisis=== | |||

| Taleb appeared to be vindicated against ] in 2008, as he reportedly made a multi-million dollar fortune during the ], a crisis which he attributed to the failure of statistical methods in finance <ref>, Stephanie Baker-Said, ], October 14 2008</ref><ref>http://www.youtube.com/watch?v=_Jli7xPOvIA</ref>. ], where Taleb is advisor, made returns of 65% to 115% in October 2008 in its approximately $2 billion “Black Swan Protection Protocol.” <ref name=WallSt>http://online.wsj.com/article/SB122567265138591705.html</ref> | |||

| He has also proposed that biological, economic, and other systems exhibit an ability to benefit and grow from volatility—including particular types of random errors and events—a characteristic of these systems that he terms ''].''<ref name="epigenetics" /><ref name="danchinsynd" /> Relatedly, he also believes that universities are better at public relations and claiming credit than generating knowledge. He argues that knowledge and technology are usually generated by what he calls "] tinkering" rather than by top-down directed research,<ref>Nassim Nicholas Taleb, 2001, {{Webarchive|url=https://web.archive.org/web/20081208203350/http://edge.org/q2007/q07_5.html#taleb |date=8 December 2008 }}, at ''Edge'' (online), 11 September 2001, accessed 7 May 2015.</ref><ref>Ma'n Barāzī, 2009, , Beirut, Lebanon: Data & Investment Consult – Lebanon, p. 182, accessed 7 May 2015.</ref>{{rp|182}} and has proposed option-like experimentation as a way to outperform directed research as a method of scientific discovery, an approach he terms ''convex tinkering.''<ref name=TalebAntifragile12>Nassim Nicholas Taleb, 2012, ''],'' ] ({{ISBN|0679645276}}) and ] ({{ISBN|0718197909}}), accessed 7 May 2015.</ref>{{rp|181''ff'', 213''ff'', 236''ff''}} | |||

| Taleb's financial success coupled with his earlier predictions have seen him catapulted to prominence. He has appeared on numerous magazine covers and television shows to discuss his views <ref>http://business.timesonline.co.uk/tol/business/economics/article4022091.ece</ref> <ref>http://business.timesonline.co.uk/tol/business/economics/article4022091.ece</ref> Taleb started being treated as a "rock star" in Davos 2009 in which he had harsh words for bankers <ref>http://www.washingtonpost.com/wp-dyn/content/article/2009/01/30/AR2009013002726.html </ref> <ref>http://dealbook.blogs.nytimes.com/2009/01/28/a-rallying-cry-to-claw-back-bonuses/</ref>. | |||

| Taleb has called for discontinuation of the ], saying that the damage from economic theories can be devastating.<ref>Nassim Nicholas Taleb, 2007, "Opinion: The pseudo-science hurting markets," at '']'' (online), 23 October 2007, see and , accessed 7 May 2014.</ref><ref>{{cite news |last=Cox |first=Adam |url=https://www.reuters.com/article/idUSTRE68R2SK20100928 |title=Blame Nobel for crisis, says author of 'Black Swan |work=] |date=28 September 2010}}</ref> He opposes top-down knowledge as an academic illusion.<ref name="econtalk">{{cite podcast|url=http://www.econtalk.org/archives/2009/03/taleb_on_the_fi.html |title=Taleb on the Financial Crisis |host=Russ Roberts |work=The Library of Economics and Liberty}}</ref> Together with Espen Gaarder Haug, Taleb asserts that option pricing is determined in a "heuristic way" by market participants, not by a model, and that models are "lecturing birds on how to fly".<ref name="econtalk" /> Teacher and author Pablo Triana has explored this topic with reference to Haug and Taleb.<ref>Triana, Pablo. ''Lecturing Birds on Flying: Can Mathematical Theories Destroy the Financial Markets?'' Wiley Publishing (2009).</ref> Triana has stated that Taleb might be correct in recommending that retail banks be treated as ], i.e. forbidden to take potentially disastrous risks, whereas hedge funds and other less-regulated investment entities need not be subject to similar restrictions.<ref>{{cite news|last=Garcia|first=Cardiff de Alejo |url=http://www.efinancialnews.com/story/2009-06-12/q-and-a-part-ii-alternatives-to-measuring-risk |title=Q&A Part II: Alternatives to measuring risk|work=]|date=12 June 2009}}</ref> | |||

| In an article in ], ] described Taleb as "now the hottest thinker in the world". <ref>, ], ], June 1, 2008</ref> The ] Laureate ] proposed the inclusion of Taleb's name among the world's top intellectuals, citing "Taleb has changed the way many people think about uncertainty, particularly in the financial markets. His book, ''The Black Swan'', is an original and audacious analysis of the ways in which humans try to make sense of unexpected events." <ref name=kahneman></ref> | |||

| In his writings, Taleb has identified and discussed the error of comparing real-world randomness with the "structured randomness" in ] (where probabilities are computable) or games of chance such as casino gambling, in which the probabilities are purposefully constructed by casino management.<ref>Cooke, D., & Logan, C. (2021). Violent extremism: The practical assessment and management of risk. In Terrorism Risk Assessment Instruments (pp. 99-115). IOS Press.</ref><ref name=Cornwell>{{cite news |last=Cornwell |first=John |url=https://entertainment.timesonline.co.uk/tol/arts_and_entertainment/books/non-fiction/article1708246.ece |archive-url=https://archive.today/20080511203955/http://entertainment.timesonline.co.uk/tol/arts_and_entertainment/books/non-fiction/article1708246.ece |url-status=dead |archive-date=11 May 2008 |title=Random thoughts on the road to riches |work=] |date=29 April 2007}}</ref> Taleb calls this the "]". He argues that predictive models suffer from ], gravitating towards mathematical purity and failing to take certain key ideas into account such as the impossibility of possessing all relevant information; that small unknown variations in the data can have a huge impact; and flawed theories/models based on empirical data and that fail to consider events that have not taken place but could take place. Discussing the ludic fallacy in ''The Black Swan'', he writes, "The dark side of the moon is harder to see; beaming light on it costs energy. In the same way, beaming light on the unseen is costly, in both computational and mental effort." | |||

| ==Approach to Models Linked to Austrian Economics== | |||

| In the second edition of ''The Black Swan'', he posited that the foundations of ] are faulty and highly self-referential. He states that statistics is fundamentally incomplete as a field, as it cannot predict the risk of rare events, a problem that is acute in proportion to the rarity of these events. With the mathematician ], he called the problem ''statistical undecidability'' (Douady and Taleb, 2010).<ref>{{Cite web|last2=Taleb|first2=Nassim Nicholas |first1=Raphael |last1=Douady |author-link=Raphael Douady|date=October 2010 |title=Statistical Undecidability |url=http://www.datascienceassn.org/sites/default/files/Statistical%20Undecidability.pdf |access-date=3 December 2020 |website=data science assn}}</ref> | |||

| Taleb <ref name="econtalk"> Taleb on the Financial Crisis, Podcast, Hosted by Russ Roberts, The Library of Economics and Liberty </ref> in his criticism of models has taken an ] point of view. He opposes top-down knowledge as an academic illusion and believes that price formation obeys an organic process. In his paper with ] <ref name="econtalk"> </ref> asserts that option pricing is determined in a "heuristic way" by operators, not by a model, and that models are "lecturing birds on how to fly", except that in the case of options, the birds might listen. See also Pablo Triana's book "Lecturing Birds on Flying: Can Mathematical Theories Destroy the Financial Markets?" Wiley Publishing (2009) where Triana goes in depth about this topic with a series of references to Haug and Taleb and gives strong critics to the Black-Scholes-Merton model. | |||

| Taleb has described his main challenge as mapping his ideas of "robustification" and "]", that is, how to live and act in a world we do not understand and build robustness to black swan events. Taleb introduced the idea of the "fourth quadrant" in the exposure domain.<ref>Taleb, N. N. (2009). Errors, robustness, and the fourth quadrant. </ref> One of its applications is in his definition of the most effective (that is, least fragile) risk management approach: what he calls the "]" which is based on avoiding the middle in favor of linear combination of extremes, across all domains from politics to economics to one's personal life. These are deemed by Taleb to be more robust to estimation errors. For instance, he suggests that investing money in 'medium risk' investments is pointless, because risk is difficult, if not impossible to compute. His preferred strategy is to be both hyper-conservative and hyper-aggressive at the same time. For example, an investor might put 80 to 90% of their money in extremely safe instruments, such as treasury bills, with the remainder going into highly risky and diversified speculative bets. An alternative suggestion is to engage in highly speculative bets with a limited downside. | |||

| ==Criticism== | |||

| Taleb asserts that by adopting these strategies, a portfolio can be "robust", i.e. gain a positive exposure to black swan events while limiting losses suffered by such random events.<ref>Taleb, ''The Black Swan'', pg 207</ref>{{rp|207}} Together with ] and ], he modeled a ] barbell "to constrain only what can be constrained (in a robust manner) and to maximize entropy elsewhere", based on an insight by E. T. Jaynes that economic life increases in entropy under regulatory and other constraints.<ref>{{cite journal |last1 = Geman |first1 = D. |last2 = Geman |first2 = H. |last3 = Taleb |first3 = N. N. |author-link1=Donald Geman|author-link2=Hélyette Geman| year = 2015 |title = Tail risk constraints and maximum entropy |journal = Entropy |volume = 17 |issue = 6|page = 3724 | doi=10.3390/e17063724| arxiv = 1412.7647| bibcode = 2015Entrp..17.3724G| s2cid = 2273464 |doi-access = free }}</ref> Taleb also applies a similar barbell-style approach to health and exercise. Instead of doing steady and moderate exercise daily, he suggests that it is better to do a low-effort exercise such as walking slowly most of the time, while occasionally expending extreme effort. He claims that the human body evolved to live in a random environment, with various unexpected but intense efforts and much rest.<ref>{{cite book |first=Nassim Nicholas |last=Taleb |year=2012 |title=Antifragile: Things That Gain from Disorder |publisher=]|title-link=Antifragile: Things That Gain from Disorder }}</ref> | |||

| Taleb's contention that statisticians can be ] when it comes to financial risks and risks of blowups, masking their incompetence with complicated equations, has attracted criticism from some statisticians. | |||

| Taleb appeared with ]<ref>{{cite web |url=http://rationalreview.com/archives/290382|title=Ron Paul Liberty Report, 3/15/18 |date=16 March 2018|access-date=24 March 2018|archive-url=https://web.archive.org/web/20180319004808/http://rationalreview.com/archives/290382|archive-date=19 March 2018|url-status=dead}}</ref> and ]<ref>{{cite web |url=https://ralphnaderradiohour.com/skin-in-the-game/ |title=Skin in the Game – Ralph Nader Radio Hour |website=ralphnaderradiohour.com |date=10 March 2018 |access-date=24 March 2018 |archive-date=22 May 2020 |archive-url=https://web.archive.org/web/20200522110505/https://ralphnaderradiohour.com/skin-in-the-game/ |url-status=dead}}</ref> on their respective shows in support of ''Skin in the Game'', which was dedicated to both men.<ref>{{cite book |url=https://books.google.com/books?id=vqZJDwAAQBAJ&q=%22Ralph+Nader%22&pg=PA32 |title=Skin in the Game: Hidden Asymmetries in Daily Life – Nassim Nicholas Taleb |access-date=11 April 2018 |isbn=978-0425284629 |last1=Taleb |first1=Nassim Nicholas |year=2018 |publisher=Random House Publishing }}</ref> After the ], however, Taleb publicly supported an aggressive response against Russia and denounced "naive libertarians, who think I'm like them because they like my books."<ref>{{cite web |url=https://medium.com/incerto/a-clash-of-two-systems-47009e9715e2 |title=A Clash of Two Systems |magazine=] |date=19 April 2022 }}</ref> | |||

| The American Statistical Association devoted the August 2007 issue of ''The American Statistician'' to ''The Black Swan'', in which statisticians offered a mixture of praise and criticism for Taleb's main points, mostly focused on Taleb's writing style and Taleb's representation of the statistical literature. | |||

| ] writes that Taleb in ''Black Swan'' is "reckless at times and subject to grandiose overstatements; the professional statistician will find the book ubiquitously naive."<ref name=lund:00>Lund, R. (2007) "Revenge of the white swan," ''American Statistician'', 61(4), 189-192.</ref> ] opines that "the book reads as if Taleb has never heard of nonparametric methods, data analysis, visualization tools or robust estimation," <ref name=brown>] (2007) "Strong language on black swans," ''American Statistician'' 61(3), 195-97.</ref> although he also calls the book "essential reading" and urges statisticians to overlook the insults to get the "important philosophic and mathematical truths." Westfall and Hilbe (2007), while praising the book, complain that Taleb's criticism is "often-unfounded and sometimes outrageous."<ref name=westfall>Westfall, P. and J. Hilbe, "The Black Swan: Praise and criticism," ''The American Statistician'', 61(3), 193-94.</ref> Taleb's contentious style draws comments such as, "with few exceptions, the writers and professionals describes are knaves or fools, mostly fools. His writing is full of irrelevances, asides and colloquialisms, reading like the conversation of a raconteur rather than a tightly argued thesis."<ref name=westfall/>. Taleb reacted by blaming the academics for "bad faith" by targeting a literary book that claimed to be a literary book and ignoring the empirical evidence provided in his appendix and more technical works <ref>http://www.fooledbyrandomness.com/blackswan-technical.htm</ref> | |||

| Taleb wrote in ] and in scientific papers<ref>Taleb, N. N. (July 2018). (Anti) Fragility and Convex Responses in Medicine. In International Conference on Complex Systems (pp. 299–325). Springer, Cham.</ref> that if the statistical structure of habits in modern society differ too greatly from the ancestral environment of humanity, the analysis of consumption should focus less on composition and more on frequency. In other words, studies that ignore the random nature of supply of nutrients are invalid. | |||

| The late Berkeley statistician ] said that efforts by statisticians to refute Taleb's point that rare events with major consequences are poorly dealt with by conventional statistics had been unconvincing.<ref>http://www.stat.berkeley.edu/~census/crow.pdf</ref> | |||

| Taleb co-authored a paper with ] and ] called ''Systemic risk of pandemic via novel pathogens – Coronavirus: A note''. The paper, published on 26 January 2020, took the position that the ] was not being taken seriously enough by policy makers and medical professionals.<ref>{{cite magazine |url=https://www.newyorker.com/news/daily-comment/the-pandemic-isnt-a-black-swan-but-a-portent-of-a-more-fragile-global-system |title=The Pandemic Isn't a Black Swan but a Portent of a More Fragile Global System |magazine=] |date=21 April 2020 }}</ref> | |||

| On a ] show Taleb said that he was pleased that none of the criticism he received for "The Black Swan" had any substance as it was either unintelligent or ]/], which convinced him to "go for the jugular" with a huge financial bet on the breakdown of statistical methods in finance. <ref>http://www.charlierose.com/view/interview/9713</ref> | |||

| == Criticism and reactions == | |||

| Taleb and ] have traded personal attacks. Taleb said that Scholes is responsible to the financial crises of 2008, and suggested that "This guy should be in a retirement home doing Sudoku, His funds have blown up twice. He shouldn't be allowed in Washington to lecture anyone on risk" <ref>Slate </ref>. Scholes retorted that Taleb simply "popularises ideas and is making money selling books". Scholes also claimed that Taleb does not cite previous literature, and for this reason Taleb is not taken seriously in academia.<ref> Financial times, link 1: , link to the same page: </ref>. Listing his academic works on the topics in "The Black Swan" Taleb said that "Academics should comment on data there not make technical comments on a LITERARY book" <ref> Black Swan academic works </ref> | |||

| ], a ] and ], said regarding ''The Black Swan'' that "the book reads as if Taleb has never heard of ], ], visualization tools or ]."<ref name="brown">{{cite journal |last1=Brown |first1=Aaron |author-link=Aaron Brown (financial author) |year=2007 |title=Strong language on black swans |journal=] |volume=61 |issue=3 |pages=195–97 |doi=10.1198/000313007x220011 |s2cid=120488719}}</ref> Nonetheless, he calls the book "essential reading" and urges statisticians to overlook the insults to get the "important philosophic and mathematical truths." Taleb replied in the second edition of ''The Black Swan'' that "One of the most common (but useless) comments I hear is that some solutions can come from 'robust statistics.' I wonder how using these techniques can create information where there is none".<ref>'']'', 2nd, edition, p. 353</ref>{{rp|353}} In 2007, Westfall and ] complained that Taleb's criticism is "often unfounded and sometimes outrageous."<ref name="westfall">{{cite journal |last1=Westfall |first1=P. |last2=Hilbe |first2=J. |author-link2=Joseph Hilbe |year=2007 |title=The Black Swan: Praise and Criticism |journal=] |volume=61 |issue=3 |pages=193–194 |doi=10.1198/000313007x219383 |s2cid=120638553}}</ref> Taleb, writes ], "describes writers and professionals as knaves or fools, mostly fools ... Yet beneath his rage and mockery are serious issues. The risk management models in use today exclude the very events against which they claim to protect the businesses that employ them. These models import a veneer of technical sophistication ... "<ref>{{cite news |last=Kay |first=John |author-link=John Kay (economist) |date=27 April 2007 |title=Books: Unimaginable horror |work=] |url=http://www.ft.com/cms/s/0/824ac36c-f134-11db-838b-000b5df10621.html |access-date=7 May 2016}}</ref> Berkeley statistician ] said that efforts by statisticians to refute Taleb's stance have been unconvincing.<ref>{{cite web |last=Freedman |first=David A. |author-link=David Freedman (statistician) |title=Black Ravens, White Shoes, and Case Selection |url=http://www.stat.berkeley.edu/~census/crow.pdf |access-date=7 May 2015 |publisher=]}}</ref> | |||

| Taleb contends that statisticians can be ] when it comes to risks of rare events and risks of blowups, and mask their incompetence with complicated equations.<ref>{{cite web |last=Taleb |first=Nassim Nicholas |date=2013 |title=What We Learn From Firefighters |url=http://edge.org/response-detail/23839 |access-date=7 May 2015 |publisher=] |quote=Simply, one observation in 10,000, that is, one day in 40 years, can explain the bulk of the "]", a measure of what we call "]s", that is, how much the distribution under consideration departs from the standard ], or the role of remote events in determining the total properties. For the U.S. stock market, a single day, ], determined 80% of the kurtosis. The same problem is found with interest and exchange rates, commodities, and other variables. The problem is not just that the data had "fat tails"... it was that we would never be able to determine "how fat" the tails were.}}</ref> This stance has attracted criticism: the ] devoted the August 2007 issue of '']'' to ''The Black Swan''. The magazine offered a mixture of praise and criticism for Taleb's main points, with a focus on Taleb's writing style and his representation of the statistical literature. Robert Lund, a mathematics professor at ], writes that in ''Black Swan'', Taleb is "reckless at times and subject to grandiose overstatements; the professional statistician will find the book ubiquitously naive."<ref name="lund:00">{{cite journal |last1=Lund |first1=Robert |year=2007 |title=Revenge of the white swan |journal=] |volume=61 |issue=4 |pages=189–92 |doi=10.1198/000313007X219374 |s2cid=122874205}}</ref> However, Lund acknowledges that "there are many points where I agree with Taleb," and writes that "the book is a must" for anyone "remotely interested in finance and/or philosophical probability." | |||

| ==Bibliography== | |||

| ===Books=== | |||

| *{{cite book | author=Taleb, Nassim Nicholas | title=] | publisher=] | location=New York | year=2001/2005 | isbn=0-8129-7521-9}} | |||

| *{{cite book | author=Taleb, Nassim Nicholas | title=Le Hasard Sauvage | location=Paris | publisher=Les Belles Lettres | year=2005 | isbn=2-251-44297-9}} The French edition of ''Fooled by Randomness'' with revisions and changes to to the English version. | |||

| *{{cite book | author=Taleb, Nassim Nicholas | title=] | publisher=] | location=New York | year=2007 | isbn=978-1-4000-6351-2}} | |||

| Taleb and Nobel laureate ] have traded personal attacks, particularly after Taleb's paper with {{Interlanguage link|Espen Gaarder Haug|no}}, in which Taleb alleged that nobody uses the ]. Taleb accused Scholes of being responsible for the ], and suggested that "this guy should be in a retirement home doing ]. His funds have blown up twice. He shouldn't be allowed in Washington to lecture anyone on risk." Scholes retorted that Taleb simply "popularises ideas and is making money selling books". Scholes claimed that Taleb does not cite previous literature, and for this reason Taleb is not taken seriously in academia.<ref>{{cite news |first=Anuj |last=Gangahar |url=http://www.ft.com/cms/fb971062-0b4c-11dd-8ccf-0000779fd2ac.html |title=Mispriced risk tests market faith in a prized formula |work=] |date=16 April 2008}}</ref> Haug and Taleb (2011) listed hundreds of research documents showing the Black–Scholes formula was not derived by Scholes, and argued that the economics establishment ignored literature by practitioners and mathematicians such as ], who many years earlier, had developed a more sophisticated version of the formula.<ref>{{cite journal |url=http://www.maths.usyd.edu.au/u/UG/SM/MATH3075/r/Haug_Taleb_2011.pdf |title=Option traders use (very) sophisticated heuristics, never the Black–Scholes–Merton formula |journal=]}}</ref> | |||

| ===Scholarly publications=== | |||

| *{{cite book | author=Taleb, Nassim Nicholas| title=Dynamic Hedging: Managing Vanilla and Exotic Options | publisher=] | location=New York | year=1997 | isbn=0-471-15280-3}} | |||

| * Taleb, N. N. (2004) “Randomness and the Arts”, Literary Criticism/Critique Littéraire | |||

| *Taleb, N. N. (2004) “Bleed or Blowup: What Does Empirical Psychology Tell Us About the Preference For Negative Skewness? ”, Journal of Behavioral Finance, 5 | |||

| * Taleb, N. N. (2004) "I problemi epistemologici del risk management " in: Daniele Pace (a cura di) Economia del rischio. Antologia di scritti su rischio e decisione economica, Giuffrè, Milano | |||

| *Derman, E. and Taleb, N.N. (2005) , ''Quantitative Finance'', vol. 5, 4 | |||

| *Goldstein, D.G. and Taleb, N.N. (2007) , ''Journal of Portfolio Management'', Summer 2007. | |||

| *Taleb, N.N. (2007) , ''The American Statistician'', August 2007, Vol. 61, No. 3 | |||

| *] and Taleb, N.N. (2008) , ] | |||

| * Taleb, N. N. (2008) , Complexity, 14(2). | |||

| *Taleb, N., and Tapiero, C. (forthcoming) | |||

| * Taleb, N.N. (in Press), , International Journal of Forecasting (forthcoming) | |||

| * Mandelbrot, B. and Taleb, N.N. (in Press). Random Jump, not Random Walk. In Francis Diebold and Richard Herring (Eds.), ''The Known, the Unknown, and the Unknowable'', Princeton University Press | |||

| *Pilpel, A. and Taleb, N.N., 2009 (in Press), “Beliefs, Decisions, and Probability” , in (eds. T. O' Connor & C. Sandis) ''A Companion to the Philosophy of Action'' (Wiley-Blackwell). | |||

| Taleb's outspoken and directed commentary against parts of the finance industry—e.g., saying at Davos in 2009 that he was "happy" that ] collapsed—was followed by reports of threats and personal attacks.<ref>{{cite news |url=https://www.wsj.com/articles/SB123457658749086809 | work=] | title=Overheard | date=14 February 2009}}</ref> | |||

| ===Collaborations=== | |||

| * Taleb is collaborating with ] on a general theory of risk management.<ref name=FT>{{cite news | |||

| | last = Benoit Mandelbrot and | |||

| | first = Nassim Taleb | |||

| | title = A focus on the exceptions that prove the rule | |||

| | work = ] | |||

| |date=March 23, 2006 | |||

| | url = | |||

| http://www.ft.com/cms/s/5372968a-ba82-11da-980d-0000779e2340,dwp_uuid=77a9a0e8-b442-11da-bd61-0000779e2340.html | |||

| | accessdate = 2007-06-05 }}</ref> | |||

| * Taleb also works with ] on a project to test empirically people's intuitions about ecological and high impact uncertainty.<ref name=DGGNT>{{Citation | |||

| | last = Goldstein | |||

| | first = D. G. | |||

| | author-link = Daniel Goldstein | |||

| | last2 = Taleb | |||

| | first2 = N. N. | |||

| | author2-link = Nassim Taleb | |||

| | title = We don't quite know what we are talking about when we talk about volatility | |||

| | journal = Journal of Portfolio Management | |||

| | volume = | |||

| | issue = | |||

| | pages = | |||

| | date = In press | |||

| | year = in press | |||

| | url = http://papers.ssrn.com/sol3/papers.cfm?abstract_id=970480 | |||

| }}</ref> | |||

| Taleb is known for his uncensored criticism of public figures and institutions. He has referred to former UK Prime Minister ] as "a very dishonourable fellow" and Blair's successor, ] as "an idiot". He has criticized prominent economists like ], ] and ], stating that "they cause more crises than they solve". He has also been critical of the ] at ], calling it the "International Association of Namedroppers" and stating "they think it's their mission to solve a problem they don't understand."<ref>{{cite web |title=Nassim Nicholas Taleb uncensored: Gordon Brown is 'an idiot', Obama a 'fossil system' |url=https://economictimes.indiatimes.com/magazines/panache/nassim-nicholas-taleb-uncensored-gordon-brown-is-an-idiot-obama-a-fossil-system/articleshow/56799562.cms |website=The Economic Times |access-date=19 November 2024 |date=27 January 2017}}</ref> | |||

| ==Honors== | |||

| * Inducted into the Derivatives Hall of Fame in February 2001.<ref name=DS2>{{cite web | |||

| | title = 2000 Hall of Fame | |||

| | publisher = Derivatives Strategy magazine | |||

| | month = March | year = 2000 | |||

| | url = http://www.derivativesstrategy.com/magazine/archive/2001/0301fea1.asp | |||

| | accessdate = 2006-09-19 }}</ref> | |||

| * Selected for the Power 30 in Business by SmartMoney /Wall Street Journal Magazine (October 2007). | |||

| * 2007 ]. Previous winners of the getAbstract Book Award include ], ], ] and ]. | |||

| * 2008 ] Visionary of the Year Award. <ref>http://www.frost.com/prod/servlet/summits-details.pag?eventid=107066069</ref> | |||

| * 2008 ] Top Intellectual of the Year, short list <ref> http://www.prospect-magazine.co.uk/article_details.php?id=10558</ref> | |||

| == Recognition and honors == | |||

| ==Quotations== | |||

| * 2009: '']'' magazine list of "Most Influential Management Gurus"<ref>{{cite news |url=https://www.forbes.com/2009/10/13/influential-business-thinkers-leadership-thought-leaders-chart.html|title= Forbes List of the Top Business Thinkers | first=Klaus | last=Kneale|date=14 October 2009}}</ref> | |||

| {{wikiquote|Nassim Nicholas Taleb}} | |||

| * 2011: ]<ref>{{cite news | url=http://topics.bloomberg.com/the-50-most-influential-people-in-global-finance/ | work=Topics.bloomberg.com | title=The 50 Most Influential People in Global Finance | access-date=7 May 2015 | url-status=dead | archive-url=https://archive.today/20120716235136/http://topics.bloomberg.com/the-50-most-influential-people-in-global-finance/ | archive-date=16 July 2012 }}</ref> | |||

| * "My major hobby is teasing people who take themselves and the quality of their knowledge too seriously and those who don’t have the guts to sometimes say: '''I don’t know....''" <ref>{{cite web | |||

| * 2013, 2014, 2015: Most influential 100 thought leaders in the world by the ]<ref>{{cite web |url=http://www.gdi.ch/en/Think-Tank/GDI-News/News-Detail/Thought-Leaders-2014-the-most-influential-thinkers |title=GDI – Think Tank |publisher=]}}</ref> | |||

| | title = Nassim Nicholas Taleb's Home Page | |||

| * 2016: Delivered the 2016 commencement speech at the ].<ref name="AUBcommence">{{cite web |date=27 May 2016 |title=Nassim Taleb: Commencement Address 2016 |url=https://www.aub.edu.lb/commencement/Documents/speeches-16/nassim-taleb.pdf |access-date=10 June 2016 |publisher=American University of Beirut}}</ref> | |||

| | url = http://www.fooledbyrandomness.com/ | |||

| * 2018: ] for contributions to decision making under complicated and less-idealized probabilistic structures using Mathematica. | |||

| | accessdate = 2007-06-07 }}</ref> | |||

| == |

== Bibliography == | ||

| === Books === | |||

| * ] | |||

| ==== Incerto series ==== | |||

| * ] | |||

| ''Incerto'' is a group of works by Taleb as philosophical essays on uncertainty. It was bundled into a group of four works in November 2016 {{ISBN|978-0399590450}}. A fifth book, ''Skin in the Game'', was published in February 2018. This fifth book is bundled with the other four works in July 2019 as ''Incerto'' (Deluxe Edition) {{ISBN|978-1984819819}}. | |||

| * ] | |||

| * {{cite book | title=Fooled by Randomness: The Hidden Role of Chance in Life and in the Markets | title-link=Fooled by Randomness | publisher=] | location=New York | year=2001 | isbn=978-0-8129-7521-5 <!--| url=https://archive.org/details/fooledbyrandomne00tale_2--> }} Second ed., 2005. {{ISBN|1-58799-190-X}}. | |||

| * {{cite book| title=The Black Swan: The Impact of the Highly Improbable| title-link=The Black Swan (Taleb book)| publisher=] and ]| location=New York| year=2007| isbn=978-1-4000-6351-2<!--| url=https://archive.org/details/blackswanimpacto00tale--> }} Expanded 2nd ed, 2010 {{ISBN|978-0812973815}}. | |||

| * {{cite book | title=The Bed of Procrustes: Philosophical and Practical Aphorisms | title-link=The Bed of Procrustes | publisher=] | location=New York | year=2010 | isbn=978-1-4000-6997-2 <!--| url=https://archive.org/details/bedofprocrustesp00tale--> }} Expanded 2nd ed, 2016 {{ISBN|978-0812982404}}. | |||

| * {{cite book | title=Antifragile: Things That Gain from Disorder | title-link=Antifragile (book) | publisher=] | location=New York | year=2012 | isbn=978-1-4000-6782-4 <!--| url=https://archive.org/details/isbn_9781400067824--> }} | |||

| * {{cite book <!--| first=Nassim Nicholas | last=Taleb | author-link=Nassim Nicholas Taleb -->| title=Skin in the Game: Hidden Asymmetries in Daily Life | title-link=Skin in the Game (book) | publisher=] | location=New York | year=2018 | isbn=978-0-4252-8462-9}} (This book was not published with the original bundling of the ''Incerto'' series.) | |||

| ==== Technical Incerto ==== | |||

| ==References== | |||

| * {{cite book <!--| first=Nassim Nicholas | last=Taleb | author-link=Nassim Nicholas Taleb -->| title= Statistical Consequences of Fat Tails: Real World Pre-asymptotics, Epistemology, and Applications (Technical Incerto Vol. 1)| publisher=STEM Academic Press | year=2020 | isbn=978-1-5445-0805-4}} | |||

| {{reflist|2}} | |||

| == |

==== Other ==== | ||

| * {{cite book <!--| first=Nassim Nicholas | last=Taleb | author-link=Nassim Nicholas Taleb -->| title=Dynamic Hedging: Managing Vanilla and Exotic Options | publisher=] | location=New York | year=1997 | isbn=978-0-471-15280-4}} | |||

| * {{cite book |first1=Nassim Nicholas |last1=Taleb <!--| author-link=Nassim Nicholas Taleb -->|first2=Pasquale |last2=Cirillo |title=The Logic and Statistics of Fat Tails | publisher=] | location=London | year=2018 | isbn=978-0-1419-8836-8}} | |||

| === |

=== Selected papers === | ||

| * Taleb, N. N., & West, J. (2023). Working with convex responses: Antifragility from finance to oncology. Entropy, 25(2), 343. | |||

| * Podcast interview with Nassim Taleb at ] | |||

| * {{cite journal |last1=Cirillo |first1=P. |last2=Taleb |first2=N. N. |title=Tail risk of contagious diseases|journal=Nature Physics |volume=16 |issue= 6|year=2020 |pages=606–613 | |||

| *- Econtalk presenting Taleb's Austrian economics point of view about the crisis. | |||

| |doi=10.1038/s41567-020-0921-x |arxiv=2004.08658 |bibcode=2020NatPh..16..606C |s2cid=215828381 }} | |||

| * on ] | |||

| * Taleb, N.N.; Norman, J.; Bar-Yam, Y; (26 January 2020) "Systemic Risk of Pandemic via Novel Pathogens – Coronavirus: A Note". ''Academia.edu.'' | |||

| * Taleb, N. N. (2019). Medicine and Risk Transfer. Foresight: The International Journal of Applied Forecasting, (53), 31-32. | |||

| * {{cite journal |last1=Taleb |first1=N. N. |last2=Douady |first2=R. |author-link2=Raphael Douady |title=Mathematical definition, mapping, and detection of (anti)fragility |journal=Quantitative Finance |volume=13 |issue=11 |year=2013 |pages=1677–1689 | |||

| |doi=10.1080/14697688.2013.800219 |arxiv=1208.1189 |s2cid=219716527 }} | |||

| * {{cite journal |last1=Taleb |first1=N. N. |title=Unique Option Pricing Measure with neither Dynamic Hedging nor Complete Markets |journal=European Financial Management |volume=21 |issue=2 |year=2015 |pages=228–235 |doi=10.1111/eufm.12055 |s2cid=153841924 }} | |||

| * {{cite journal|last1=Geman |first1=D. |author-link=Donald Geman |last2=Geman |first2=H. |author-link2=Hélyette Geman |last3=Taleb |first3=N. N. |title=Tail Risk Constraints and Maximum Entropy |journal=] |volume=17 |issue= 6|year=2015 |pages=1–14 |doi=10.3390/e17063724|bibcode=2015Entrp..17.3724G|arxiv=1412.7647 |s2cid=2273464 |doi-access=free }} | |||

| * {{cite journal |last1=Taleb |first1=N. N. |last2=Douady |first2=R. |author-link2=Raphael Douady |title=On the Super-Additivity and Estimation Biases of Quantile Contributions |journal=] |volume=429 |year=2015 |pages=252–260 |doi=10.1016/j.physa.2015.02.038 |bibcode=2015PhyA..429..252T|arxiv=1405.1791 |s2cid=23527680 }} | |||

| * {{cite journal |last1=Cirillo |first1=P. |last2=Taleb |first2=N. N. |title=On the tail risk of violent conflict and its underestimation |journal=]|volume=452 |year=2016 |pages=29–45 |doi=10.1016/j.physa.2016.01.050 |bibcode=2016PhyA..452...29C|arxiv=1505.04722 |s2cid=9716627 }} | |||

| * {{cite journal |last1=Taleb |first1=N. N. |title=Election predictions as martingales: an arbitrage approach |journal=Quantitative Finance|volume=452 |issue=1 |year= 2018 |pages=1–5 |doi=10.1080/14697688.2017.1395230|arxiv=1703.06351 |s2cid=158466482 }} | |||

| * {{cite journal |last1=Taleb |first1=N. N. |title=How much data do you need? An operational, pre-asymptotic metric for fat-tailedness |journal=International Journal of Forecasting |volume=35 |issue=2 |date= 2018 |pages=677–686 |doi=10.1016/j.ijforecast.2018.10.003|arxiv=1802.05495 |s2cid=139102471 }} | |||

| == See also == | |||

| * ] | |||

| * Taleb in discussion with Sir ] and Constantine Sandis (after Ali Allawi interview) | |||

| * ] | |||

| * ] | |||

| * ] | |||

| == Notes == | |||

| {{notelist}} | |||

| * | |||

| == References == | |||

| {{Reflist}} | |||

| * - Summary and Review of Fooled By Randomness | |||

| * | |||

| * | |||

| * '']'' article by ]: | |||

| * — Profile from The Sunday Times by Bryan Appleyard | |||

| == External links == | |||

| {{Commons category|Nassim Nicholas Taleb}} | |||

| * | |||

| {{wikiquote}} | |||

| * | |||

| * |

* | ||

| * {{IMDb name|2643232}} | |||

| * - Early warning on banking risks. | |||

| * {{Google Scholar id|64BtMdsAAAAJ}} | |||

| * - In Conversation with Constantine Sandis. | |||

| * {{C-SPAN|1025409}} | |||

| {{Nassim Nicholas Taleb}} | |||

| <!-- Metadata: see ] --> | |||

| {{Authority control}} | |||

| {{Persondata | |||

| |NAME= Taleb, Nassim Nicholas | |||

| |ALTERNATIVE NAMES= Taleb, Nessim; Taleb, Nissim | |||

| |SHORT DESCRIPTION= Philosopher | |||

| |DATE OF BIRTH= 1960 | |||

| |PLACE OF BIRTH= ], ] | |||

| |DATE OF DEATH= | |||

| |PLACE OF DEATH= | |||

| }} | |||

| {{DEFAULTSORT:Taleb, Nassim Nicholas}} | {{DEFAULTSORT:Taleb, Nassim Nicholas}} | ||

| ] | ] | ||

| ] | |||

| ] | |||

| ] | |||

| ] | |||

| ] | |||

| ] | |||

| ] | ] | ||

| ] | ] | ||

| ] | ] | ||

| ] | |||

| ] | |||

| ] | |||

| ] | |||

| ] | |||

| ] | |||

| ] | ] | ||

| ] | |||

| ] | |||

| ] | |||

| ] | |||

| ] | |||

| ] | |||

| ] | |||

| ] | |||

| ] | |||

| ] | |||

| ] | |||

| ] | |||

| ] | |||

| ] | |||

| ] | |||

| ] | |||

| ] | |||

| ] | |||

| ] | |||

| ] | |||

| ] | |||

| ] | |||

| ] | |||

| ] | |||

| ] | |||

| ] | |||

| ] | |||

| ] | |||

Latest revision as of 23:33, 15 January 2025

Lebanese-American author (born 1960)

| Nassim Nicholas Taleb | |

|---|---|

Taleb in 2010 Taleb in 2010 | |

| Born | 12 September 1960 (1960-09-12) (age 64) Amioun, Lebanon |

| Nationality | Lebanese and American |

| Alma mater | |

| Known for | Applied epistemology, antifragility, black swan theory, ludic fallacy, antilibrary |

| Awards | Bruno Leoni Award, Wolfram Innovator Award |

| Scientific career | |

| Fields | decision theory, risk, probability |

| Institutions | New York University University of Massachusetts Amherst |

| Thesis | The Microstructure of Dynamic Hedging (1998) |

| Doctoral advisor | Hélyette Geman |

| Website | fooledbyrandomness |

Nassim Nicholas Taleb (/ˈtɑːləb/; alternatively Nessim or Nissim; born 12 September 1960) is a Lebanese-American essayist, mathematical statistician, former option trader, risk analyst, and aphorist. His work concerns problems of randomness, probability, complexity, and uncertainty.

Taleb is the author of the Incerto, a five-volume work on the nature of uncertainty published between 2001 and 2018 (notably, The Black Swan and Antifragile). He has taught at several universities, serving as a Distinguished Professor of Risk Engineering at the New York University Tandon School of Engineering since September 2008. He has also been a practitioner of mathematical finance and is currently an adviser at Universa Investments. The Sunday Times described his 2007 book The Black Swan as one of the 12 most influential books since World War II.

Taleb criticized risk management methods used by the finance industry and warned about financial crises, subsequently profiting from the Black Monday (1987) and the 2007–2008 financial crisis. He advocates what he calls a "black swan robust" society, meaning a society that can withstand difficult-to-predict events. He proposes what he has termed "antifragility" in systems; that is, an ability to benefit and grow from a certain class of random events, errors, and volatility, as well as "convex tinkering" as a method of scientific discovery, by which he means that decentralized experimentation outperforms directed research.

Early life and family background

Taleb was born in Amioun, Lebanon, to Minerva Ghosn and Nagib Taleb, an oncologist and a researcher in anthropology. His parents were Greek Orthodox Christians, and had French citizenship. His maternal grandfather Fouad Nicolas Ghosn [Wikidata] and great-grandfather Nicolas Ghosn [Wikidata] were both deputy prime ministers of Lebanon in the 1940s through the 1970s, and his four-times great grandfather was one of the board of directors to the administrator of Mount Lebanon. His paternal grandfather Nassim Taleb was a supreme court judge. Taleb attended a French school in Beirut, the Grand Lycée Franco-Libanais. His family saw its political prominence and wealth reduced by the Lebanese Civil War, which began in 1975. He is a Greek Orthodox Christian.

Education

Taleb received Bachelor and Master of Science degrees from the University of Paris. He holds a MBA from the Wharton School at the University of Pennsylvania (1983), and a PhD in management science from the University of Paris (Dauphine) (1998), under the direction of Hélyette Geman. His dissertation focused on the mathematics of derivatives pricing.

Career

Finance

Taleb has been a practitioner of mathematical finance as a hedge fund manager, and a derivatives trader. He has held the following positions: managing director and proprietary trader at Credit Suisse UBS, currency trader at First Boston, chief currency derivatives trader for Banque Indosuez, managing director and worldwide head of financial option arbitrage at CIBC Wood Gundy, derivatives arbitrage trader at Bankers Trust (now Deutsche Bank), proprietary trader at BNP Paribas, independent option market maker on the Chicago Mercantile Exchange and hedge fund manager for Empirica Capital.

Taleb reportedly became financially independent after the crash of 1987 from his hedged short Eurodollar position while working as a trader for First Boston. Next, Taleb pursued work toward his PhD in Paris, completing the degree program in 1998. He returned to New York City and founded Empirica Capital in 1999. During the market downturn in 2000, at the end of the dot com bubble and burst, Empirica's Empirica Kurtosis LLC fund was reported to have made a 56.86% return. Taleb's investing strategies continued to be highly successful during the Nasdaq dive in 2000 Several consecutive years of low market volatility and less spectacular returns followed, and Empirica closed in 2004. In 2007, Taleb joined his former Empirica partner, Mark Spitznagel, as an adviser to Universa Investments, an asset management company based on the "black swan" idea, owned and managed by Spitznagel in Miami, Florida.

Taleb attributed the 2007–2008 financial crisis, to the mismatch between reality and statistical distributions used in finance. Taleb's investing approach produced significant returns once again, with some Universa funds returning 65% to 115% in October 2008. In a 2007 Wall Street Journal article, Taleb claimed he retired from trading and would be a full-time author. He describes the nature of his involvement as "totally passive" from 2010 on.