| Revision as of 10:19, 19 October 2011 editLawrencekhoo (talk | contribs)Extended confirmed users, Pending changes reviewers, Rollbackers29,827 edits Reverted 1 edit by Vision Thing (talk): Bordering on vandalism. (TW)← Previous edit | Revision as of 17:04, 19 October 2011 edit undoVision Thing (talk | contribs)7,574 edits rm until RFC is concludedNext edit → | ||

| Line 8: | Line 8: | ||

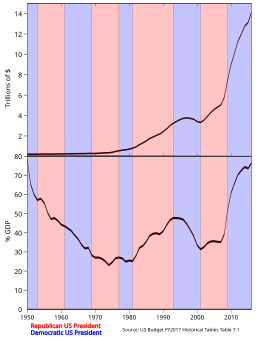

| Economist Mike Kimel notes that the five former Democratic Presidents (], ], ], ], and ]) all reduced public debt as a share of GDP, while the last four Republican Presidents (], ], ], and ]) all oversaw an increase in the country’s indebtedness.<ref>{{cite web |url= http://www.angrybearblog.com/2007/12/republican-party-and-national-debt.html |title=The Republican Party and the National Debt |first=Mike |last=Kimel |work=angrybearblog.com |date=2007-12-04 |accessdate=15 April 2011}}</ref> Economic historian ], former Clinton Treasury Department official, observes a contrast not so much between Republicans and Democrats, but between Democrats and "old-style Republicans (Eisenhower and Nixon)" on one hand (decreasing debt), and "new-style Republicans" on the other (increasing debt).<ref>{{cite web|author=Brad DeLong |url=http://seekingalpha.com/article/174445-comparing-debt-to-gdp-ratios-with-presidential-terms |title=Comparing Debt-to-GDP Ratios with Presidential Terms |publisher=Seeking Alpha |date=2009-11-20 |accessdate=2010-08-09 |quote=contrast between the Democrats and the old-style Republicans (Eisenhower and Nixon) on the one hand and the new-style Republicans on the other is quite striking.}}</ref><ref>{{cite web|author=Brad DeLong |url=http://delong.typepad.com/sdj/2008/05/short-term-cost.html |title=Short-Term Costs of Long-Run Fiscal Stupidity - Grasping Reality with Both Hands |publisher=Delong.typepad.com |date=2008-05-01 |accessdate=2010-08-09}}</ref> | Economist Mike Kimel notes that the five former Democratic Presidents (], ], ], ], and ]) all reduced public debt as a share of GDP, while the last four Republican Presidents (], ], ], and ]) all oversaw an increase in the country’s indebtedness.<ref>{{cite web |url= http://www.angrybearblog.com/2007/12/republican-party-and-national-debt.html |title=The Republican Party and the National Debt |first=Mike |last=Kimel |work=angrybearblog.com |date=2007-12-04 |accessdate=15 April 2011}}</ref> Economic historian ], former Clinton Treasury Department official, observes a contrast not so much between Republicans and Democrats, but between Democrats and "old-style Republicans (Eisenhower and Nixon)" on one hand (decreasing debt), and "new-style Republicans" on the other (increasing debt).<ref>{{cite web|author=Brad DeLong |url=http://seekingalpha.com/article/174445-comparing-debt-to-gdp-ratios-with-presidential-terms |title=Comparing Debt-to-GDP Ratios with Presidential Terms |publisher=Seeking Alpha |date=2009-11-20 |accessdate=2010-08-09 |quote=contrast between the Democrats and the old-style Republicans (Eisenhower and Nixon) on the one hand and the new-style Republicans on the other is quite striking.}}</ref><ref>{{cite web|author=Brad DeLong |url=http://delong.typepad.com/sdj/2008/05/short-term-cost.html |title=Short-Term Costs of Long-Run Fiscal Stupidity - Grasping Reality with Both Hands |publisher=Delong.typepad.com |date=2008-05-01 |accessdate=2010-08-09}}</ref> | ||

| ], director of the Office of Management and Budget under President Ronald Reagan, as op-ed contributor to the ], blamed the "ideological tax-cutters" of the ] for the increase of national debt during the 1980s.<ref name="Stockman">{{Cite journal|last=Stockman |first=David |url= http://www.nytimes.com/2010/08/01/opinion/01stockman.html?_r=1 |title=Four Deformations of the Apocalypse |publisher=nytimes.com |journal=New York Times |date=2010-07-31 |accessdate=2010-08-09}}</ref> | |||

| Using nominal dollar measures, ]'s ] and ]'s Mark Knoller have noted that the US national debt has increased more rapidly under President Obama than under any other U.S. president, and that it had increased by $4 trillion since the beginning of his term of office.<ref>{{cite news |title=National debt has increased $4 trillion under Obama |url=http://www.cbsnews.com/8301-503544_162-20095704-503544.html |newspaper=] |date=22 August 2011 |accessdate=25 August 2011}}</ref><ref>{{cite news |title=Tea Party effect on 2012 elections? |url=http://caffertyfile.blogs.cnn.com/2011/08/23/tea-party-effect-on-2012-elections/ |newspaper=] |date=23 August 2011 |accessdate=25 August 2011}}</ref> | Using nominal dollar measures, ]'s ] and ]'s Mark Knoller have noted that the US national debt has increased more rapidly under President Obama than under any other U.S. president, and that it had increased by $4 trillion since the beginning of his term of office.<ref>{{cite news |title=National debt has increased $4 trillion under Obama |url=http://www.cbsnews.com/8301-503544_162-20095704-503544.html |newspaper=] |date=22 August 2011 |accessdate=25 August 2011}}</ref><ref>{{cite news |title=Tea Party effect on 2012 elections? |url=http://caffertyfile.blogs.cnn.com/2011/08/23/tea-party-effect-on-2012-elections/ |newspaper=] |date=23 August 2011 |accessdate=25 August 2011}}</ref> | ||

Revision as of 17:04, 19 October 2011

In the United States, national debt is money borrowed by the federal government of the United States. Debt burden is usually measured as a ratio of public debt to gross domestic product; the U.S. debt/GDP ratio reached a maximum during World War II near the beginning of President Harry Truman's first presidential term.

The President proposes the budget for the government to the US Congress. Congress may change the budget, but it rarely appropriates more than what the President requests.

Commentary

| The neutrality of this section is disputed. Relevant discussion may be found on the talk page. Please do not remove this message until conditions to do so are met. (August 2011) (Learn how and when to remove this message) |

Economist Mike Kimel notes that the five former Democratic Presidents (Bill Clinton, Jimmy Carter, Lyndon B. Johnson, John F. Kennedy, and Harry S. Truman) all reduced public debt as a share of GDP, while the last four Republican Presidents (George W. Bush, George H. W. Bush, Ronald Reagan, and Gerald Ford) all oversaw an increase in the country’s indebtedness. Economic historian J. Bradford DeLong, former Clinton Treasury Department official, observes a contrast not so much between Republicans and Democrats, but between Democrats and "old-style Republicans (Eisenhower and Nixon)" on one hand (decreasing debt), and "new-style Republicans" on the other (increasing debt).

David Stockman, director of the Office of Management and Budget under President Ronald Reagan, as op-ed contributor to the New York Times, blamed the "ideological tax-cutters" of the Reagan administration for the increase of national debt during the 1980s.

Using nominal dollar measures, CNN's Jack Cafferty and CBS's Mark Knoller have noted that the US national debt has increased more rapidly under President Obama than under any other U.S. president, and that it had increased by $4 trillion since the beginning of his term of office.

Gross federal debt

This table lists the gross U.S. federal debt as a percentage of GDP by Presidential term since World War II. The current gross federal debt as a percentage of GDP (83.4% at the end of 2009) is currently the highest it has been since the late 1940s. The debt briefly reached over 100% of GDP in the aftermath of World War II.

These figures do not include unfunded obligations. The U.S. government is committed under current law to mandatory payments for programs such as Medicare, Medicaid and Social Security. The 2009 present value of these deficits or unfunded obligations is an estimated $45.8 trillion. This is the amount that would have to be set aside such that the principal and interest would pay for the unfunded commitments through 2084. Approximately $7.7 trillion relates to Social Security, while $38.2 trillion relates to Medicare and Medicaid. Adding this to the national debt and other federal commitments brings the total obligations to nearly $62 trillion. However, these amounts are excluded from the national debt computation.

The President proposes the budget for the government to the congress, which can amend it before passing. The U. S. Constitution in Article 1, Section 7 grants exclusive right to originate revenue related bills to the House of Representatives; the President's proposals are an indication of spending desired, but it is the House which defines the spending through the final wording of the bills. Since the budget resolution is a “concurrent” congressional resolution, not an ordinary bill, it does not go to the President for his signature or veto. While this leaves substantial room for the legislature to change the deficit, congressional historian Louis Fisher observes that, "Congress rarely appropriates more than what the President requests." In the case of Nixon, who fought fiercely with Congress over the budget, he writes, "Congress was able to adhere to the President's totals while significantly altering his priorities."

| U.S. president | Party | Years | Start debt/GDP | End debt/GDP | Increase debt (in Billions of $) |

Increase debt/GDP (in percentage points) |

House Control (with # if split during term) |

Senate Control (with # if split during term) |

|---|---|---|---|---|---|---|---|---|

| Roosevelt | D | 1941–1945 | 50.4% | 117.5% | +203 | +67.1% | D | D |

| Roosevelt/Truman | D | 1945–1949 | 117.5% | 93.1% | -8 | -24.4% | 79th D, 80th R | 79th D, 80th R |

| Truman Harry Truman | D | 1949–1953 | 93.1% | 71.4% | +13 | -21.7% | D | D |

| Eisenhower1 Dwight Eisenhower | R | 1953–1957 | 71.4% | 60.4% | +6 | -11.0% | 83rd R, 84th D | 83rd R, 84th D |

| Eisenhower2 Dwight Eisenhower | R | 1957–1961 | 60.4% | 55.2% | +20 | -5.2% | D | D |

| Kennedy/Johnson | D | 1961–1965 | 55.2% | 46.9% | +30 | -8.3% | D | D |

| Johnson Lyndon Johnson | D | 1965–1969 | 46.9% | 38.6% | +43 | -8.3% | D | D |

| Nixon1 Richard Nixon | R | 1969–1973 | 38.6% | 35.6% | +101 | -3.0% | D | D |

| Nixon2 Nixon/Ford | R | 1973–1977 | 35.6% | 35.8% | +177 | +0.2% | D | D |

| Carter Jimmy Carter | D | 1977–1981 | 35.8% | 32.5% | +288 | -3.3% | D | D |

| Reagan1 Ronald Reagan | R | 1981–1985 | 32.5% | 43.8% | +823 | +11.3% | D | R |

| Reagan2 Ronald Reagan | R | 1985–1989 | 43.8% | 53.1% | +1,050 | +9.3% | D | 99th R, 100th D |

| Bush GHW George H. W. Bush | R | 1989–1993 | 53.1% | 66.1% | +1,483 | +13.0% | D | D |

| Clinton1 Bill Clinton | D | 1993–1997 | 66.1% | 65.4% | +1,018 | -0.7% | 103rd D, 104th R | 103rd D, 104th R |

| Clinton2 Bill Clinton | D | 1997–2001 | 65.4% | 56.4% | +401 | -9.0% | R | R |

| Bush GW1 George W. Bush | R | 2001–2005 | 56.4% | 63.5% | +2,135 | +7.1% | R | 107th Split, 108 R |

| Bush GW2 George W. Bush | R | 2005–2009 | 63.5% | 84.2% | +3,971 | +20.7% | 109th R, 110th D | 109th R, 110th D |

| Obama1 Barack Obama |

D | 2009–2010 | 84.2% | 93.2% | +1,653 | +9.0% | 111th D, 112th R | D |

(Source: CBO Historical Budget Page and Whitehouse FY 2012 Budget - Table 7.1 Federal Debt at the End of Year PDF, Excel, Senate.gov)

Notes:

- For net jobs changes over the corresponding periods, see: Jobs created during U.S. presidential terms.

Public debt

Gross debt and public debt are different. Public debt is the gross debt minus intra-governmental obligations (such as the money that the government owes to the two Social Security Trust Funds, the Old-Age, Survivors, and Disability Insurance program, and the Social Security Disability Insurance program).

The figures show the trend in public debt with the background colored by the party controlling the executive and legislative branches of government. The color of the trend line does not represent party affiliation; only the background color does.

Federal spending, federal debt, and GDP

The table below shows the annual federal spending, gross federal debt, and gross domestic product for average presidential parties, specific presidential terms, and specific fiscal years.

| Fiscal Year | President | Party of President | Federal Spending | Federal Debt | Gross Domestic Product | Inflation Adjustor | ||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Billions | Adjusted | Increase | Billions | Adjusted | Percentage Increase | Billions | Adjusted | Increase | ||||

| 1978-2005 | Democratic | 9.9% | 4.2% | 12.6% | ||||||||

| 1978-2005 | Republican | 12.1% | 36.4% | 10.7% | ||||||||

| 1978–1981 | Carter | Democratic | $678 | $1,219 | 17.2% | $994 | $1,787 | -0.4% | $3,055 | $5,492 | 9.4% | |

| 1982–1985 | Reagan | Republican | $946 | $1,396 | 14.5% | $1,817 | $2,680 | 49.0% | $4,142 | $6,108 | 11.2% | |

| 1986–1989 | Reagan | Republican | $1,144 | $1,499 | 7.4% | $2,867 | $3,757 | 40.2% | $5,401 | $7,077 | 15.9% | |

| 1990–1993 | Bush | Republican | $1,410 | $1,615 | 7.8% | $4,351 | $4,987 | 32.7% | $6,576 | $7,536 | 6.5% | |

| 1994–1997 | Clinton | Democratic | $1,601 | $1,684 | 4.3% | $5,369 | $5,647 | 13.2% | $8,182 | $8,606 | 14.2% | |

| 1998–2001 | Clinton | Democratic | $1,863 | $1,821 | 8.1% | $5,769 | $5,638 | -0.2% | $10,058 | $9,829 | 14.2% | |

| 2002–2005 | Bush | Republican | $2,472 | $2,165 | 18.9% | $7,905 | $6,923 | 22.8% | $12,238 | $10,717 | 9.0% | |

| 2006-2009* | Bush | Republican | $3,107 | $2,452 | 13.3% | $10,413 | $8,218 | 18.7% | $15,027 | $11,859 | 10.7% | |

| 1977 | Ford | Republican | $409 | $1,040 | $706 | $1,795 | $1,974 | $5,019 | 0.39 | |||

| 1978 | Carter | Democratic | $459 | $1,093 | 5.1% | $776 | $1,850 | 3.1% | $2,217 | $5,285 | 5.3% | 0.42 |

| 1979 | Carter | Democratic | $504 | $1,107 | 1.3% | $829 | $1,821 | -1.5% | $2,501 | $5,494 | 4.0% | 0.46 |

| 1980 | Carter | Democratic | $591 | $1,175 | 6.1% | $909 | $1,808 | -0.8% | $2,727 | $5,422 | -1.3% | 0.50 |

| 1981 | Carter | Democratic | $678 | $1,219 | 3.8% | $994 | $1,787 | -1.1% | $3,055 | $5,492 | 1.3% | 0.56 |

| 1982 | Reagan | Republican | $746 | $1,252 | 2.6% | $1,137 | $1,908 | 6.8% | $3,228 | $5,417 | -1.4% | 0.60 |

| 1983 | Reagan | Republican | $808 | $1,294 | 3.4% | $1,371 | $2,195 | 15.0% | $3,441 | $5,510 | 1.7% | 0.62 |

| 1984 | Reagan | Republican | $852 | $1,300 | 0.4% | $1,564 | $2,386 | 8.7% | $3,840 | $5,858 | 6.3% | 0.66 |

| 1985 | Reagan | Republican | $946 | $1,396 | 7.4% | $1,817 | $2,680 | 12.3% | $4,142 | $6,108 | 4.3% | 0.68 |

| 1986 | Reagan | Republican | $990 | $1,426 | 2.1% | $2,120 | $3,052 | 13.9% | $4,412 | $6,352 | 4.0% | 0.69 |

| 1987 | Reagan | Republican | $1,004 | $1,406 | -1.4% | $2,345 | $3,283 | 7.6% | $4,647 | $6,506 | 2.4% | 0.71 |

| 1988 | Reagan | Republican | $1,065 | $1,447 | 2.9% | $2,601 | $3,534 | 7.7% | $5,009 | $6,806 | 4.6% | 0.74 |

| 1989 | Reagan | Republican | $1,144 | $1,499 | 3.6% | $2,867 | $3,757 | 6.3% | $5,401 | $7,077 | 4.0% | 0.76 |

| 1990 | Bush | Republican | $1,253 | $1,590 | 6.1% | $3,206 | $4,067 | 8.3% | $5,735 | $7,277 | 2.8% | 0.79 |

| 1991 | Bush | Republican | $1,324 | $1,610 | 1.3% | $3,598 | $4,374 | 7.5% | $5,935 | $7,215 | -0.8% | 0.82 |

| 1992 | Bush | Republican | $1,382 | $1,624 | 0.9% | $4,001 | $4,703 | 7.5% | $6,240 | $7,334 | 1.7% | 0.85 |

| 1993 | Bush | Republican | $1,410 | $1,615 | -0.5% | $4,351 | $4,987 | 6.0% | $6,576 | $7,536 | 2.8% | 0.87 |

| 1994 | Clinton | Democratic | $1,462 | $1,642 | 1.7% | $4,643 | $5,216 | 4.6% | $6,961 | $7,820 | 3.8% | 0.89 |

| 1995 | Clinton | Democratic | $1,516 | $1,662 | 1.2% | $4,920 | $5,395 | 3.4% | $7,326 | $8,033 | 2.7% | 0.91 |

| 1996 | Clinton | Democratic | $1,561 | $1,673 | 0.7% | $5,181 | $5,554 | 3.0% | $7,694 | $8,248 | 2.7% | 0.93 |

| 1997 | Clinton | Democratic | $1,601 | $1,684 | 0.7% | $5,369 | $5,647 | 1.7% | $8,182 | $8,606 | 4.3% | 0.95 |

| 1998 | Clinton | Democratic | $1,653 | $1,721 | 2.2% | $5,478 | $5,704 | 1.0% | $8,628 | $8,985 | 4.4% | 0.96 |

| 1999 | Clinton | Democratic | $1,702 | $1,746 | 1.5% | $5,605 | $5,750 | 0.8% | $9,125 | $9,361 | 4.2% | 0.97 |

| 2000 | Clinton | Democratic | $1,789 | $1,789 | 2.5% | $5,628 | $5,628 | -2.1% | $9,710 | $9,710 | 3.7% | 1.00 |

| 2001 | Clinton | Democratic | $1,863 | $1,821 | 1.8% | $5,769 | $5,638 | 0.2% | $10,058 | $9,829 | 1.2% | 1.02 |

| 2002 | Bush | Republican | $2,011 | $1,929 | 6.0% | $6,198 | $5,945 | 5.5% | $10,377 | $9,954 | 1.3% | 1.04 |

| 2003 | Bush | Republican | $2,160 | $2,018 | 4.6% | $6,760 | $6,316 | 6.2% | $10,809 | $10,099 | 1.4% | 1.07 |

| 2004 | Bush | Republican | $2,293 | $2,082 | 3.2% | $7,354 | $6,677 | 5.7% | $11,500 | $10,441 | 3.4% | 1.10 |

| 2005 | Bush | Republican | $2,472 | $2,165 | 4.0% | $7,905 | $6,923 | 3.7% | $12,238 | $10,717 | 2.6% | 1.14 |

| 2006 | Bush | Republican | $2,655 | $2,249 | 3.9% | $8,451 | $7,158 | 3.4% | $13,016 | $11,024 | 2.9% | 1.18 |

| 2007 | Bush | Republican | $2,730 | $2,263 | 0.6% | $8,951 | $7,419 | 3.6% | $13,668 | $11,329 | 2.8% | 1.21 |

| 2008* | Bush | Republican | $2,931 | $2,366 | 4.6% | $9,654 | $7,793 | 5.0% | $14,312 | $11,553 | 0% | 1.24 |

| 2009 | Bush | Republican | $3,107 | $2,452 | 3.6% | $10,413 | $8,218 | 5.5% | $14,097 | $11,529 | 2.6% | 1.27 |

| 2010* | Obama | Democratic | $3,091 | $2,392 | -2.4% | $11,875 | $9,247 | 12.5% | $14,508 | $11,297 | -2.0% | 1.29 |

Notes

- The government fiscal year runs from October 1 (of the previous calendar year) to September 30. Budgets are enacted before the November general elections. This is why FY2001 falls under Clinton and FY2009 falls under G.W. Bush, they started in October 1, 2000 and October 1, 2008, respectively.

- The dollar amounts for each presidential term are taken from the last fiscal year in that term.

- The increase in each presidential term is the increase in the adjusted amount from the last fiscal year of the previous term to the last fiscal year of the current term.

- The value for each presidential party is the average of the values for all the presidents in that party.

- The values for the years 2008, 2009, and 2010 represent estimates from the source material.

See also

Notes

- Fisher, Louis (Nov. - Dec. 1990). "Federal Budget Doldrums: The Vacuum in Presidential Leadership". Public Administration Review. 50 (6): 693–700. doi:10.2307/976984. JSTOR 976984.

{{cite journal}}: Check date values in:|date=(help) - Kimel, Mike (2007-12-04). "The Republican Party and the National Debt". angrybearblog.com. Retrieved 15 April 2011.

- Brad DeLong (2009-11-20). "Comparing Debt-to-GDP Ratios with Presidential Terms". Seeking Alpha. Retrieved 2010-08-09.

contrast between the Democrats and the old-style Republicans (Eisenhower and Nixon) on the one hand and the new-style Republicans on the other is quite striking.

- Brad DeLong (2008-05-01). "Short-Term Costs of Long-Run Fiscal Stupidity - Grasping Reality with Both Hands". Delong.typepad.com. Retrieved 2010-08-09.

- Stockman, David (2010-07-31). "Four Deformations of the Apocalypse". New York Times. nytimes.com. Retrieved 2010-08-09.

- "National debt has increased $4 trillion under Obama". CBS News. 22 August 2011. Retrieved 25 August 2011.

- "Tea Party effect on 2012 elections?". CNN. 23 August 2011. Retrieved 25 August 2011.

- The gross federal debt includes intra-government debt, i.e. money owed by one branch of the federal government to another. When this amount is subtracted the remaining quantity is known as the public debt.

- Budget FY2007

- Peter G. Peterson Foundation (April 2010). "Citizen's guide 2010: Figure 10", p. 30. Peter G. Peterson Foundation . Retrieved February 5, 2011.

- http://www.cbpp.org/cms/?fa=view&id=155

- Fisher, Louis (Nov. - Dec. 1990). "Federal Budget Doldrums: The Vacuum in Presidential Leadership". Public Administration Review. 50 (6): 693–700. doi:10.2307/976984. JSTOR 976984.

{{cite journal}}: Check date values in:|date=(help) - Frontline - Ten Trillion and Counting: Defining the Debt

- Budget FY 2009

- Budget FY2009. Addendum: Composite Deflator, page 26. Divide current dollars by this number to produce value in (constant) FY2000 dollars.

- Budget FY2009. Outlays in current dollars, page 26.

- Budget FY2009. Outlays in current dollars, page 26, divided by Inflation Adjustor.

- Budget FY 2009. Gross Federal Debt in current dollars, page 127.

- Budget FY 2009. Gross Federal Debt in current dollars, page 127, divided by Inflation Adjustor.

- Budget FY2009. GDP (Gross Domestic Product) in current dollars, page 194.

- Budget FY2009. GDP (Gross Domestic Product) in current dollars, page 194, divided by Inflation Adjustor.

References

- Budget of the United States Government, Fiscal Year 2007.

- Budget of the United States Government, Fiscal Year 2009.

- Budget of the United States Government, Fiscal Year 2012.

External links

- Another tabulation of Federal deficits (not debt) by Presidential term

- Another tabulation of Federal debt (not deficit) by Presidential term since 1976: per capita, per capita income, and as percentage of GDP

- Stephen Bloch. "U.S. Federal Deficits and Presidents". home.adelphi.edu. Retrieved 9 August 2010.

- Brad DeLong (2009-11-20). "Comparing Debt-to-GDP Ratios with Presidential Terms". Seeking Alpha. Retrieved 2010-08-09.

- Brad DeLong (2008-05-01). "Short-Term Costs of Long-Run Fiscal Stupidity - Grasping Reality with Both Hands". Delong.typepad.com. Retrieved 2010-08-09.

- Scott Willeke (2010-03-02). "United States Deficit & Debt During Presidents from 1969-2019". Blog.scott.willeke.com. Retrieved 2010-08-09.

- Steve Stoft. "U.S. National Debt Graph: What the Press Won't Tell You". Zfacts.com. Retrieved 2010-08-09.</ref>