This is an old revision of this page, as edited by Bitenthusiast (talk | contribs) at 22:44, 29 June 2012 (→External links). The present address (URL) is a permanent link to this revision, which may differ significantly from the current revision.

Revision as of 22:44, 29 June 2012 by Bitenthusiast (talk | contribs) (→External links)(diff) ← Previous revision | Latest revision (diff) | Newer revision → (diff)| This article may be too technical for most readers to understand. Please help improve it to make it understandable to non-experts, without removing the technical details. (September 2011) (Learn how and when to remove this message) |

Bitcoin-Qt Bitcoin-Qt | |

| Developer(s) | Satoshi Nakamoto (inactive, possibly a pseudonym), Gavin Andresen, Pieter Wuille, Nils Schneider, Jeff Garzik, Wladimir J. van der Laan, Gregory Maxwell, and others |

|---|---|

| Initial release | January 9, 2009 (2009-01-09) |

| Stable release | 0.6.3 / June 25, 2012; 12 years ago (2012-06-25) |

| Written in | C++ |

| Operating system | Windows, Linux, Mac OS X, FreeBSD |

| Available in | Dutch, English, French, Italian, German, Portuguese, Russian and Spanish. |

| Type | Electronic money |

| License | MIT License (open-source) |

| Website | www |

Bitcoin is a decentralized electronic cash system that uses peer-to-peer networking, digital signatures and cryptographic proof so as to enable users to conduct irreversible transactions without relying on trust. Nodes broadcast transactions to the network, which records them in a public history, called the blockchain, after validating them with a proof-of-work system. Users make transactions with bitcoins, an alternative, digital currency that the network issues according to predetermined rules. Bitcoins do not have the backing of and do not represent any government-issued currency.

The Bitcoin network came into existence on 3 January 2009 with the issuance of the first bitcoins. In the same month the creator, Satoshi Nakamoto (thought to be a pseudonym), released the original Bitcoin client as open-source software. Prior to the invention of Bitcoin, electronic commerce systems could not securely operate without relying on a central authority to prevent double-spending. Nakamoto sidestepped this requirement for Bitcoin by employing a proof-of-work approach in a peer-to-peer network to reach consensus between peers on the validity of transactions. Bitcoin is a relatively new project under active development. As such, its developers caution that users should treat it as experimental software.

Network

Owners transfer bitcoins by sending them to another Bitcoin address using a website or program designed for this purpose. Under the hood, the software transfers the coins by generating a digital signature to link the prior transaction with the public key of the next owner. Bitcoin nodes record all data necessary to make any valid transaction in a publicly distributed database called the block chain. Nodes build the block chain using a proof-of-work system that prevents double-spending and confirms transactions.

Bitcoin addresses

Bitcoin uses public-key cryptography using Elliptic Curve DSA. Every user in the Bitcoin network has a digital wallet containing a number of cryptographic keypairs. The wallet's public keys are transformed into Bitcoin addresses, which act as the receiving endpoints for all payments. Addresses in human-readable form appear as strings of numbers and letters around 33 characters in length, always beginning with the digit 1 or 3, as in the example of 175tWpb8K1S7NmH4Zx6rewF9WQrcZv245W. The wallet's private keys are used to authorize transactions from that user's wallet.

Users obtain new Bitcoin addresses from any Bitcoin client software, including web-based Bitcoin wallets. Creating a new address is a completely offline process and requires no communication with the Bitcoin peer-to-peer network.

Most Bitcoin addresses look like meaningless random characters. It is possible to get more personalized addresses using programs that generate addresses rapidly, keeping ones matching some specific pattern. Examples such as 1LoveUNuf2az5e2m7v9kGRAFHYjDaf4jju with the 1LoveU prefix can be obtained in a few minutes on an average desktop computer.

Transactions with Bitcoin

A Bitcoin software client uses a wallet, a collection of the user's addresses and corresponding private encryption keys. Users can create as many Bitcoin addresses as they wish. When user A wants to transfer bitcoins to user B, A creates a transaction message indicating that some of the balance associated with their Bitcoin wallet is to be sent to the address of B, and A's Bitcoin client signs the transaction with the address's private keys.

Because of the asymmetric cryptographic method, only the owner's private keys are able to create a valid signature to send coins from their Bitcoin wallet. The private keys cannot be determined from the signature – they are a secret known only to the address owner. The owner's node broadcasts the resulting message to send money, the transaction, on the peer-to-peer network. Other members of the peer-to-peer network validate the cryptographic signatures and the amounts of the transaction before accepting the money transfer.

Confirmations

To prevent double-spending, the network implements what Nakamoto describes as a peer-to-peer distributed timestamp server, which assigns sequential identifiers to each transaction, which are then hardened against modification using the idea of chained proofs of work (shown in the Bitcoin client as confirmations). In his white paper, Nakamoto wrote: "we propose a solution to the double-spending problem using a peer-to-peer distributed timestamp server to generate computational proof of the chronological order of transactions."

Whenever a node broadcasts a transaction, the network immediately labels it as unconfirmed. The confirmation status reflects the likelihood that an attempt to reverse the transaction could succeed. Any transaction broadcast to other nodes does not become confirmed until the network acknowledges it in a collectively maintained timestamped-list of all known transactions, the block chain.

Target

Every generating node in the Bitcoin network collects all the unacknowledged transactions it knows of in a file called a block, which also contains a reference to the previous valid block known to that node. It then appends a nonce value to this previous block and computes the SHA-256 cryptographic hash of the block and the appended nonce value. The node repeats this process until it adds a nonce that allows for the generation of a hash with a value lower than a specified target. Because computers cannot practically reverse the hash function, finding such a nonce is hard and requires on average a predictable amount of repetitious trial and error. This is where the proof-of-work concept comes in to play. When a node finds such a solution, it announces it to the rest of the network. Peers receiving the new solved block validate it by computing the hash and checking that it really starts with the given number of zero bits (i.e., that the hash is within the target). Then they accept it and add it to the chain.

Block chain

The network confirms a transaction when it records it in a block. Further blocks generated further confirm it. After six confirmations, most Bitcoin clients considers a transaction confirmed beyond reasonable doubt. After this, it is overwhelmingly likely that the transactions are part of the main block chain rather than an orphaned one, and impractical to reverse.

Eventually, the block chain contains the cryptographic ownership history of all coins from their creator-address to their current owner-address. Therefore, if a user attempts to reuse coins he already spent, the network rejects the transaction.

The network must store the whole transaction history inside the block chain, which grows constantly as new records are added and never removed. Nakamoto conceived that as the database became larger, users would desire applications for Bitcoin that didn't store the entire database on their computer. To enable this, the system uses a Merkle tree to organize the transaction records in such a way that a future Bitcoin client can locally delete portions of its own database it knows it will never need, such as earlier transaction records of bitcoins that have changed ownership multiple times, while keeping the cryptographic integrity of the remaining database intact. Some users will only need the portion of the block chain that pertains to the coins they own or might receive in the future. At the present time however, all users of the Bitcoin software receive the entire database over the peer-to-peer network after running the software the first time. As of April 2012, this database is approximately 1.2 gigabytes (raw block data without any indexing or optimization).

Difficulty

When more people mine for coins , and everything else stays the same, blocks will generate more quickly. In order to throttle the creation of blocks (and thus keep miners on a more even platform as well as keep the network stable and prevent unnecessary forking of the block chain), the difficulty of generating the next block is mathematically adjusted. Referring back to the Target section, a block is generated when a hash value is found that is less than a certain threshold (or, more simply, starts with more zeros). Since lower thresholds mean less possible hashes can be accepted, the more zeros a hash requires to start with, the more difficult it will be to find an acceptable hash. When mining increases (more clients mining or more efficient ways of mining are found), the difficulty increases, and when mining decreases, the difficulty decreases. This keeps block generation at about every 10 minutes per block.

| This section may be too technical for most readers to understand. Please help improve it to make it understandable to non-experts, without removing the technical details. (May 2012) (Learn how and when to remove this message) |

As more people use more (or less) computing power to try to generate valid blocks, the rate of block creation varies. To compensate for this growth and to keep the rate of block creation close to the desired average of one block every ten minutes, Bitcoin changes the difficulty of finding a valid block every 2016 blocks. Each node in the network adjusts the difficulty so the distribution mean is λ = 2016 blocks per two weeks, so that there are roughly ten minutes between the creation of new blocks on average (the wait times between events in a Poisson process follow an exponential distribution). The network sets the difficulty to the value that would have most likely caused the prior 2016 blocks to take two weeks to complete, given the same computational effort (according to the timestamps recorded in the blocks). All nodes perform and enforce the same difficulty calculation.

In addition to the pending transactions confirmed in the block, a generating node adds a "generate" transaction, which awards new bitcoins to the operator of the node that generated the block. The system sets the payout of this generated transaction according to its defined inflation schedule. Nakamoto compared the generation of new coins by expending CPU time and electricity to gold miners expending resources to add gold to circulation. The "miner" that generates a block also receives the fees that users have paid as an incentive to give particular transactions priority for faster confirmation.

A strong correlation exists between the price of bitcoins in the free market and the hashing power of the network at any specific time. Difficulty is the automatic stabilizer which allows to keep mining for bitcoins profitable in the long run for the most efficient miners. This holds true independently of the fluctuations in demand of Bitcoin in relation to other currencies.

The proof-of-work problems are especially suitable to GPUs and specialized hardware. Bitcoin users often pool computational effort to increase the stability of the collected fees and subsidy they receive.

The network never creates more than 50 BTC per block and this amount will decrease over time towards zero, such that no more than 21 million will ever exist. As this payout decreases, the incentive for users to run block-generating nodes will change to earning transaction fees.

Transaction fees

Miners have no obligation to include transactions in the blocks they try to solve. The client can associate a transaction fee with any transaction, giving miners an incentive to put the transaction in a block, as miners collect the transaction fees associated with all transactions included in blocks they solve. Very small transactions, or those that use relatively new coins, have low "priority" and the network may require a transaction fee to reduce spam. Most bitcoin clients, including Bitcoin-Qt version 0.5.2 (beta), enforce a minimum fee for low priority transactions of 0.0005 BTC.

Privacy

Because transactions are broadcast to the entire network, they are inherently public. Unlike regular banking, which preserves customer privacy by keeping transaction records private, loose transactional privacy is accomplished in Bitcoin by using many multiple unique addresses for every wallet, while at the same time publishing all transactions. As an example, if Alice sends 123.45 BTC to Bob, the network creates a public record that allows anyone to see that 123.45 has been sent from one address to another. However, unless Alice or Bob make their ownership of these addresses publicly known, it is difficult for anyone else to connect the transaction with them. However, if someone connects an address to a user at any point they could follow back a series of transactions as each participant likely knows who paid them and may disclose that information on request or under duress.

Jeff Garzik, one of the Bitcoin developers, explained as much in an interview and concluded that "attempting major illicit transactions with bitcoin, given existing statistical analysis techniques deployed in the field by law enforcement, is pretty damned dumb." He also said "We are working with the government to make sure indeed the long arm of the government can reach Bitcoin... the only way bitcoins are gonna be successful is working with regulation and with the government."

Client

Read-only access to bitcoin addresses can be achieved using various websites or software to query the number of bitcoins associated with any address. Also, the transaction history of all bitcoins is freely available to query, and because all transactions are added to the bitcoin block chain, which is a distributed database formed by all bitcoin participants, a user's bitcoin software does not need to be running for that user to receive bitcoins.

In order to be able to send bitcoins from an address (such as when purchasing products or other currencies) one must be in possession of the private key associated with that address. These are typically referred to as "wallets", and the wallet, or private key, should be considered as valuable as the bitcoins associated (or received in the future) with the address to which the private key belongs.

Wallets can be kept offline (i.e. not connected to the internet), and this is safer than storing a wallet online. Encrypting the wallet is also recommended. The more bitcoins that can be accessed using the wallet, the greater the effort that is recommended in keeping it secure.

Online wallets are usually that which is contained within the bitcoin client software, or could be an "ewallet" which is usually a web-based bitcoin client which serves multiple users.

Bitcoin payments are normally displayed to the receiver near-instantly, but the client initially displays them as unconfirmed, because the bitcoin system cannot yet assure that the transaction is permanent. The network may invalidate a transaction because of a conflict (such as the client sending the same bitcoins to two different receivers). This may happen if a sender malfunctions, or if a sender intentionally attempts to defraud a receiver. When the network processes the transaction, it adds an increasing number of confirmations every time the network extends the block-chain.

The process of confirming a transaction is accomplished by solving a computationally difficult proof-of-work problem. The problem is based on data from the transactions that must be confirmed, as well as the entire previous transaction history. This process makes it infeasible for an attacker to rewrite the transaction history without having more computing power than the rest of the bitcoin system. Nodes that process blocks of transactions are rewarded by receiving a programmed amount of bitcoin, which arises "out of thin air," as well as any transaction fees associated with the transactions they process. This compensates the operators of these systems for their computational work used to secure bitcoin transactions against reversal, and also accomplishes the initial wealth distribution for the bitcoin system as a whole. The network automatically adjusts the difficulty of the proof-of-work problem to maintain the average time between new blocks at ten minutes. All participating systems check the validity of every transaction and of every block and ignore any that violate the rules, such as blocks that bring the wrong amount of new bitcoin into existence, or transactions that would involve one sender spending the same bitcoin twice.

Implementations

Protocol implementations include the original C++ Bitcoin codebase, libbitcoin (not based on the original codebase) and an open source implementation in Java called BitCoinJ.

Currency

| |

| ISO 4217 | |

|---|---|

| Unit | |

| Plural | Bitcoins |

| Symbol | B⃦ (de facto) though ฿ sometimes used for font compatibility |

| Demographics | |

| Date of introduction | 3 January 2009 |

Unlike conventional fiat currency, Bitcoin has no centralized issuing authority. The network is programmed to increase the money supply as a geometric series until the total number of bitcoins reaches 21 million BTC. As of 2012, over 8 million of the total 21 million BTC have been mined. By 2013 half of the total supply will be generated, and by 2017, 3/4 will be generated. To ensure sufficient granularity of the money supply, clients can divide each BTC unit down to eight decimal places (a total of 2.1 × 10 or 2.1 quadrillion units). This smallest unit is colloquially called a "Satoshi".

Although the network makes the complete history of every bitcoin transaction public, it can be difficult to associate bitcoin identities with real-life identities. This property makes bitcoin transactions attractive to some sellers of illegal products who assume police will not go to the trouble.

Bitcoin as quasi-commodity money

Bitcoin shares characteristics of both commodity money and fiat money, but does not fit properly in either category. Bitcoin supersedes commodity money in value density, recognizability and divisibility and it also matches fiat money as medium of exchange. It also resembles commodity money in the fact that, at least during the expansion of the Bitcoin base, its value, assuming competing suppliers, is equal to its marginal cost of production. On the other hand, fiat money commands a value far higher than its costs of production, which raises the risk of severe mismanagement by their monopolistic suppliers.

For some of the reasons above, and for the fact that commodities are "naturally" scarce, while Bitcoin is scarce in a contrived way, and not subject to supply shocks in the usually understood sense, economist George Selgin classifies Bitcoin as Quasi-Commodity money.

Reception and concerns

Adoption

Wikileaks, Freenet, Singularity Institute, Internet Archive, Free Software Foundation and others, accept donations in Bitcoin. The Electronic Frontier Foundation did so for a while but has since stopped, citing concerns about a lack of legal precedent about new currency systems, and because they "generally don't endorse any type of product or service – and Bitcoin is no exception." Gavin Andresen, one of the main developers, is explicitly advising people "not to make heavy investments in bitcoins", calling it "kind of like a high risk investment". Jered Kenna, CEO of TradeHill, formerly a major Bitcoin Exchange, also cautions eager investors and stated to the The New York Observer that "Bitcoin is still an experiment and not to bet the house". As of July 2011, some small businesses have started to adopt Bitcoin. LaCie, a public company, accepts Bitcoin for its Wuala service. A frequent problem faced by retailers willing to accept Bitcoin is the high volatility of its exchange rate to the US dollar, as well as the absence of futures to hedge this volatility (although option contracts are available). In a review of the virtual currency, James Surowiecki opined that hoarding by speculators represented one of the largest hindrances to accelerating its adoption.

Initial distribution

Bitcoins are awarded to Bitcoin miners for the solution to a difficult proof-of-work problem which confirms transactions and prevents double-spending. This incentive, as the Nakamoto white paper describes it, encourages "nodes to support the network, and provides a way to initially distribute coins into circulation, since no central authority issues them."

The network currently requires over 1,000,000 times more work for confirming a block and receiving an award (50 BTC as of February 2012) than when the first blocks were confirmed. The network adjusts the difficulty every 2016 blocks based on the time taken to find the previous 2016 blocks such that one block is created roughly every 10 minutes. Thus the more computing power that is directed toward mining, the more computing power the network requires to complete a block confirmation and to receive the award. The network will also halve the award every 210,000 blocks, designed to occur about every four years.

Those who chose to put computational and electrical resources toward mining early on had a greater chance at receiving awards for block generations. This served to make available enough processing power to process blocks. Indeed, without miners there are no transactions and the Bitcoin economy comes to a halt.

Some criticize Bitcoin for being a Ponzi scheme in that it rewards early adopters. While early Bitcoin miners may benefit more than later ones, the returns on their investments do not come at the expense of others participating in the Bitcoin economy. The return (on invested computing power and electricity) is the reward for doing useful work in the Bitcoin network by verifying blocks, and often costs nearly as much in electricity costs as they receive.

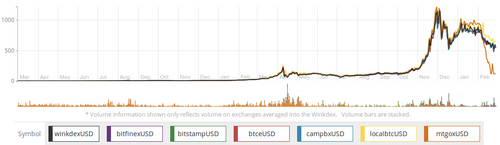

Prices

Prices fluctuate relative to goods and services more than more widely accepted currencies, since the price of a bitcoin is not yet sticky. Also, different exchanges quote different prices, implying the market is not yet efficient. On 19 June 2011, a security breach of the Mt. Gox Bitcoin Exchange (formerly the "Magic: the Gathering Online Exchange") caused the leaking of usernames, emails and MD5 hashed passwords of over 60,000 users onto the Web. The price of a bitcoin briefly dropped to $0.01 on the Mt. Gox exchange (but remained unaffected on other exchanges) after a hacker allegedly used credentials from a Mt. Gox auditor's compromised computer to illegally transfer a large number of bitcoins to himself and sell them all, creating a massive "ask" order at any price. Within minutes the price rebounded to over $15 before Mt. Gox shut down their exchange and canceled all trades that happened during the hacking period. The exchange rate of bitcoins quickly returned to near pre-crash values.

In May 2012, 1 BTC traded at around $5.00 USD. Taking into account the total number of Bitcoins in circulation, the market capitalization of the Bitcoin network stands at over 45 million USD.

Security

Until version 0.4.0, if an attacker had compromised the machine storing a particular Bitcoin wallet, then they could easily transfer any bitcoins to their own wallet. On 16 June 2011, computer security companies started publishing the discovery of malicious software that locates the wallet file on Windows computers and uploads it to a remote server. Users could prevent this attack by encrypting the wallet file; however, Bitcoin clients did not build this functionality in until wxBitcoin version 0.4.0.

Dan Kaminsky, a leading Internet technology security researcher, investigated Bitcoin. His examination reached various conclusions on Bitcoin, anonymity and its future scalability. In the area of security of the basic model he concluded Nakamoto designed Bitcoin well. This relates to the underlying Bitcoin model rather than any particular attack against a specific client, such as described above.

Extralegal uses

Covert "mining"

In June 2011, Symantec warned about the possibility of botnets engaging in covert "mining" of bitcoins (unauthorized use of computer resources to generate bitcoins), consuming computing cycles, using extra electricity and possibly increasing the temperature of the computer. Later that month, the Australian Broadcasting Corporation caught an employee using the company's servers to generate bitcoins without permission. Some malware also uses the parallel processing capabilities of the GPUs built into many modern-day video cards. In mid August 2011, bitcoin miner botnets were found; trojans infecting Mac OS X have also been uncovered.

Hacktivism

The hacking organization "LulzSec" accepted donations in Bitcoin, having said that the group "needs bitcoin donations to continue their hacking efforts". Following the banking blockade instituted against Wikileaks by mainstream payment processors such as VISA, Mastercard and Paypal, the website accepts donations in Bitcoin.

Silk Road

Silk Road is an anonymous black market that uses only Bitcoin. In a 2011 letter to Attorney General Eric Holder and the Drug Enforcement Administration, senators Charles Schumer of New York and Joe Manchin of West Virginia called for an investigation into Bitcoin and Silk Road. Schumer described the use of bitcoins at Silk Road as a form of money laundering. Consequently Amir Taaki of Intersango, a UK-based bitcoin exchange, put out a statement calling for regulation of Bitcoin exchanges by law enforcement.

Developer

Satoshi Nakamoto designed the Bitcoin system and worked on the software in 2007. In 2008, Nakamoto self-published a paper outlining his work on The Cryptography Mailing list at metzdowd.com and then on 3 January 2009 released the open source project called Bitcoin and created the first block, called the "Genesis Block." Many people other than Nakamoto contributed to the development of the Bitcoin software. The name "Satoshi Nakamoto" is believed to be a pseudonym.

See also

- Anonymous Internet banking

- Complementary currency

- Digital currency exchanger

- Digital gold currency

- Free banking

- Ripple monetary system

- Crypto-anarchism

- Economic secession

- Scrip

Digital money systems:

Notes

- Assuming the infeasibility of brute forcing the keys, and no side channel attack exists.

References

- ^ Davis, Joshua (10 October 2011). "The Crypto-Currency". The New Yorker. Retrieved 11 October 2011. Cite error: The named reference "processors" was defined multiple times with different content (see the help page).

- "Bitcoin Client Webpage".

- Bitcoin version 0.1 release date

- ^ Nakamoto, Satoshi. "Bitcoin: A Peer-to-Peer Electronic Cash System" (PDF). Cite error: The named reference "whitepaper" was defined multiple times with different content (see the help page).

- "Block 0 – Bitcoin Block Explorer".

- "Bitcoin v0.1 released".

- "SourceForge.net: Bitcoin".

- "Factbox – What is Bitcoin – currency or con?".

... A problem facing creators of non-physical currencies is how to ensure users do not spend their money twice. Before Bitcoin was invented...

- "bitcoin.org".

Bitcoin is an experimental new digital currency that enables instant payments to anyone, anywhere in the world

- Andresen, Gavin (20 June 2011). "That which does not kill us makes us stronger". GavinThink. Retrieved 15 April 2012.

I've said it before, and I'll say it again: Bitcoin is an experiment. Treat it like you would a promising Internet start-up company: maybe it will change the world, but realize that investing your money or time in new ideas is always risky.

- – Binaries for Vanitygen version 0.17

- – Source code for Vanitygen

- ^ Lowenthal, Thomas (8 June 2011). "Bitcoin: inside the encrypted, peer-to-peer digital currency". Ars Technica.

- ^ Nathan Willis (10 November 2010). "Bitcoin: Virtual money created by CPU cycles". LWN.net.

- "Bitcoin: The Crytoanarchists' Answer to Cash". IEEE.org. June 2012. Retrieved 5 June 2012.

- ^ Fergal Reid and Martin Harrigan (24 July 2011). An Analysis of Anonymity in the Bitcoin System. An Analysis of Anonymity in the Bitcoin System.

- "Bitcoin not so anonymous, Irish researcher says – Cyrus Farivar – Science and Technology". Deutsche Welle. 1 June 2011. Retrieved 29 July 2011.

- ^ Chen, Adrian (1 June 2011). "The Underground Website Where You Can Buy Any Drug Imaginable". Gawker.

- "Libertarian Dream? A Site Where You Buy Drugs With Digital Dollars – Alexis Madrigal – Technology". The Atlantic. 1 June 2011. Retrieved 22 June 2011.

- "CBSNewsOnline: BitCoin: The Future of Currency".

- Thomas Lowenthal (8 June 2011). "Bitcoin: inside the encrypted, peer-to-peer digital currency". Ars Technica. Retrieved 14 June 2011.

- angry tapir, timothy (23 March 2011). "Google Engineer Releases Open Source Bitcoin Client". Slashdot. Retrieved 18 May 2011.

- Sponsored by. "Virtual currency: Bits and bob". The Economist. Retrieved 22 June 2011.

- Geere, Duncan. "Peer-to-peer currency Bitcoin sidesteps financial institutions (Wired UK)". Wired.co.uk. Retrieved 22 June 2011.

- "Total Number of Bitcoins in Existence". Bitcoin Block Explorer. Retrieved 10 January 2012.

- "Home – Blockchain.info Block Explorer". Retrieved 7 January 2012.

- Andy Greenberg (20 April 2011). Crypto Currency. Forbes Magazine.

- Madrigal, Alexis (1 June 2011). "Libertarian Dream? A Site Where You Buy Drugs With Digital Dollars". The Atlantic Monthly. Retrieved 5 June 2011.

- Selgin, George. "Quasi-Commodity Money. Abstract". Retrieved 8 April 2012.

- Selgin, George. "Quasi-Commodity Money". Prepared for the Liberty Fund symposium, “In Search of a Monetary Constitution Revisited,” Freiburg, Germany, April 19–22, 2012. Highly preliminary: please do not quote. Retrieved 8 April 2012.

- Greenberg, Andy (14 June 2011). "WikiLeaks Asks For Anonymous Bitcoin Donations – Andy Greenberg – The Firewall – Forbes". Blogs.forbes.com. Retrieved 22 June 2011.

- "/donate". The Freenet Project. Retrieved 22 June 2011.

- SIAI donation page

- Internet Archive donation page

- Other ways to donate

- "EFF and Bitcoin | Electronic Frontier Foundation". Eff.org. 14 June 2011. Retrieved 22 June 2011.

- "/59/Bitcoin – a Digital, Decentralized Currency (at 31 min.)". omega tau podcast. 19 March 2011.

- Jeffries, Adrianne (29 May 2011). "Bit O'Money: Who's Behind the Bitcoin Bubble? | The New York Observer". Observer.com. Retrieved 24 January 2012.

- "Trade – Bitcoin". En.bitcoin.it. Retrieved 24 January 2012.

- "Secure Online Storage – Backup. Sync. Share. Access Everywhere". Wuala. Retrieved 24 January 2012.

- James Surowiecki (September/October 2011). "Cryptocurrency". Technology Review: 106.

{{cite journal}}: Check date values in:|date=(help) - "Bitcoin History Stats". Retrieved 12 December 2011.

- "Bitcoins, a Crypto-Geek Ponzi Scheme". Retrieved 15 June 2011.

- "Digital Black Friday: First Bitcoin "Depression" Hits". DailyTech. Retrieved 22 June 2011.

- "Different Bitcoin Prices on different Exchanges". Retrieved 19 July 2011.

- Clarification of Mt Gox Compromised Accounts and Major Bitcoin Sell-Off

- YouTube. Bitcoin Report

- Jason Mick, 19 June 2011, Inside the Mega-Hack of Bitcoin: the Full Story, DailyTech

- Timothy B. Lee, 19 June 2011, Bitcoin prices plummet on hacked exchange, Ars Technica

- Mark Karpeles, 20 June 2011, Huge Bitcoin sell off due to a compromised account – rollback, Mt.Gox Support

- Chirgwin, Richard (19 June 2011). "Bitcoin collapses on malicious trade – Mt Gox scrambling to raise the Titanic". The Register.

- http://www.bitcoinwatch.com/ Bitcoin statistics

- Poulsen, Kevin (16 June 2011). "New Malware Steals Your Bitcoin | Threat Level". Wired.com. Retrieved 22 June 2011.

- Updated: 17 June 2011 (17 June 2011). "All your Bitcoins are ours ... | Symantec Connect Community". Symantec.com. Retrieved 22 June 2011.

{{cite web}}: CS1 maint: numeric names: authors list (link) - "Infostealer.Coinbit". Symantec. 16 June 2011. Retrieved 22 June 2011.

- "Pickpocket Targets Wallets at Bitcoin Forum – F-Secure Weblog : News from the Lab". F-secure.com. 17 June 2011. Retrieved 22 June 2011.

- "Add wallet privkey encryption". 8 July 2011.

- Dan Kaminsky Toorcon Seattle presentation slides, http://www.slideshare.net/dakami/bitcoin-8776098

- Updated: 17 June 2011 (17 June 2011). "Bitcoin Botnet Mining | Symantec Connect Community". Symantec.com. Retrieved 24 January 2012.

{{cite web}}: Text "Translations available: 日本語" ignored (help)CS1 maint: numeric names: authors list (link) - "Researchers find malware rigged with Bitcoin miner". ZDNet. 29 June 2011. Retrieved 24 January 2012.

- "ABC employee caught mining for Bitcoins on company servers". The Next Web. 23 June 2011. Retrieved 24 January 2012.

- Goodin, Dan (16 August 2011). "Malware mints virtual currency using victim's GPU".

- "Infosecurity – Researcher discovers distributed bitcoin cracking trojan malware". Infosecurity-magazine.com. 19 August 2011. Retrieved 24 January 2012.

- "Mac OS X Trojan steals processing power to produce Bitcoins – sophos, security, malware, Intego – Vulnerabilities – Security". Techworld. 1 November 2011. Retrieved 24 January 2012.

- Reisinger, Don (9 June 2011). "Senators target Bitcoin currency, citing drug sales | The Digital Home – CNET News". News.cnet.com. Retrieved 22 June 2011.

- Olson, Parmy (6 June 2011). "LulzSec Hackers Post Sony Dev. Source Code, Get $7K Donation – Parmy Olson – Disruptors – Forbes". Blogs.forbes.com. Retrieved 22 June 2011.

- http://shop.wikileaks.org/donate#dbitcoin

- ^ Staff (12 June 2011). "Silk Road: Not Your Father's Amazon.com". NPR.

- Reuters – Bitcoin exchanges offer anti- money-laundering aid

- Britcoin.co.uk – statement to reuters from bitomat.pl and Britcoin.co.uk

- "Questions about Bitcoin". Bitcoin forum. 10 December 2009.

- "Bitcoin P2P e-cash paper".

- Satoshi's posts to Cryptography mailing list

- "Block 0 – Bitcoin Block Explorer". The Genesis Block.

- "About Bitcoin".

External links

- Bitcoin website

- The Bitcoin wiki

- Bitcoin Exchange Rate

- Charts, Stats, API for the Bitcoin network

- Peer to Peer Bitcoin Marketplace

- Bitcoin Block Explorer (Used to search transactions inside the Bitcoin block chain.)

- Rugatu Q&A Community

Categories: